Excerpts from analyst's report

|

|

More stringent regulation of industrial wastewater disposal

By 2017, all industrial parks have to install proper wastewater treatment facilities. This should benefit industrial wastewater players such as United Envirotech.

The government is targeting wastewater treatment coverage for 95% of Chinese cities and 85% of Chinese counties by 2020. Data: Maybank Kim EngAlso, wastewater discharged has to achieve Grade 1A standards (the highest) by 2017.

Data: Maybank Kim EngAlso, wastewater discharged has to achieve Grade 1A standards (the highest) by 2017.

This should benefit China Everbright Water (CEWL), SIIC Environment (SIIC) and United Envirotech (UEL).

Rise in water tariffs

The plan also urges local governments to accelerate the reform of water-pricing mechanisms. All cities must adopt tiered pricing systems by 2015.

We expect water tariffs to rise rapidly in the wake of reforms. This should improve wastewater treatment companies’ bargaining power with governments.

All 3 water treatment players will benefit.

|

Maintain OVERWEIGHT

We believe the plan will precipitate massive investments in the sector over the next few years and possibly also industry reshuffling.

Though the sector is not cheap, we reckon there could be more upside from continuous positive news flow and more attractive valuations than A-share peers.

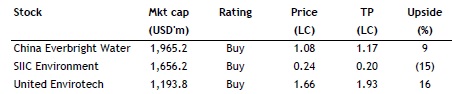

We maintain stock ratings and target prices for now, but pending future review.

Switch to CEWL from SIIC as top BUY after the latter’s recent rally. UENV’s CITIC deal remains its long-term game changer but we will only have more clarity after closure.

Full report here.