Excerpts from analyst's report

|

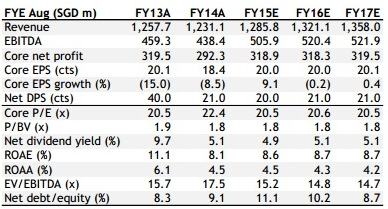

§ 1QFY8/15 net profit down 22% YoY. Core media business remained tepid. § Seletar Mall was officially opened in Nov 2014 and will start contribution from 2QFY8/15. § Maintain EPS & HOLD for lack of meaningful growth & short-term catalysts. Support from 5% dividend yields. SOTP TP still SGD4.10. |

Weak results, as expected

1QFY8/15 weakness was expected. Revenue was down 6.5% YoY and net profit, 22% YoY. Net profit of SGD69.4m made up 22% of our full-year forecast.

1QFY8/15 weakness was expected. Revenue was down 6.5% YoY and net profit, 22% YoY. Net profit of SGD69.4m made up 22% of our full-year forecast. Newspaper and Magazine revenue was down 8% YoY. Property was its only bright spark, with revenue up 1.2% on higher rental income from Paragon and Clementi Mall.

Operating costs dipped 3% YoY mainly because of lower newsprint, utility and production costs, in line with lower revenue. Core operating profit before investment income and JV contributions dropped 12% YoY to SGD102.3m.

Maintain HOLD

SPH’s core media business is likely to languish further amid a modest economic outlook. Near term, this could be partly offset by lower newsprint costs. And although 1Q net profit only formed 22% of our FY15E, we leave our EPS alone as we are expecting Seletar Mall to contribute from 2QFY8/15 and make up for the shortfall. The mall was officially opened in Nov 2014.

Maintain HOLD for lack of exciting growth with a 3.8% core profit CAGR forecast for FY8/15E-17E. No short-term catalysts expected for the stock but decent 5% dividend yields should provide price support. Our SOTP TP is still SGD4.10.