Excerpts from analysts' report

RHB analysts: Goh Han Peng & Edison Chen

| ♦ We outperformed the market last month |

Goh Han Peng♦ Sentiment has somewhat improve for equities as the market bounced back from bear market territory. The STI put up a gain of 4.7% while FTSE ST Small Cap Index up 2.4% since our October issue. Goh Han Peng♦ Sentiment has somewhat improve for equities as the market bounced back from bear market territory. The STI put up a gain of 4.7% while FTSE ST Small Cap Index up 2.4% since our October issue. ♦ Our model portfolio, notwithstanding a cash drag of 40%, handily beat the market with a return of 9.3% over the same period. Contributing to the strong performance was Yoma Strategic (+35.7%), China Aviation Oil (+14.4%), Global Invacom (+12.7%) and Singapore Shipping (+12.5%), all of which put up double digit gains. |

♦ The further cut in interest rate by the Chinese government will benefit China Aviation Oil (Unrated) as the company has been looking out for acquisition targets and has a three-year-plan to double its current profits (FY14 net profits:USD48m) through both organic growth and M&As. With a net cash of USD110m and access to low-cost debt funding, we believe that the company is working hard to secure an earning-accretive and synergistic acquisition which is related to their downstream jet fuel distribution/trading business. This will serve as an important catalyst for the share price.

♦ We continue to like Singapore Shipping Corporation (BUY, TP SGD0.59). While the stock price has been a laggard compared to the other portfolio holdings, the group recently reported a strong set of 2QFY16 results with net profit growing by 136% due to its expanded portfolio of car carrier fleet. Moreover, the recently-concluded TPP free trade agreement is set to increase seaborne trade for Japanese automotive vehicles which in turn translate to more demand for car carriers and business opportunities for Singapore Shipping to secure more long-term contracts. The stock currently trades at an attractive valuation of 6.5x FY16P/E. "We think the group (Global Invacom) is poised to turnaround sharply in 2H15," says RHB Research. While Global Invacom (BUY, TP SGD0.45) has done well on the stock front in the past one month, we believe there is much more room to go. One of the key reasons for Global Invacom’s poor 1H15 was due to orders delays from major customers in the US, UK and South-East Asia. This was due to a change in procurement procedures. However, it announced in August that these delayed orders have resumed and would contribute to its 2H15 performance. We think the group is poised to turnaround sharply in 2H15.

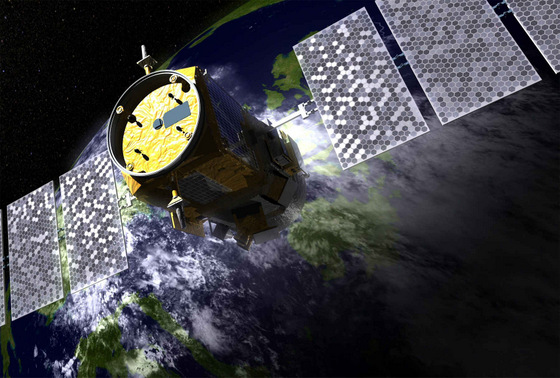

"We think the group (Global Invacom) is poised to turnaround sharply in 2H15," says RHB Research. While Global Invacom (BUY, TP SGD0.45) has done well on the stock front in the past one month, we believe there is much more room to go. One of the key reasons for Global Invacom’s poor 1H15 was due to orders delays from major customers in the US, UK and South-East Asia. This was due to a change in procurement procedures. However, it announced in August that these delayed orders have resumed and would contribute to its 2H15 performance. We think the group is poised to turnaround sharply in 2H15.

♦ Yoma Strategic. Yoma remains the best proxy for investors seeking exposure to Myanmar. The group has defined core businesses in property, automotive and consumer where it has excellent prospects to build scale and become a market leader in the chosen space. Meanwhile, the group is deliberating on its option for its 25% stake in the telecoms tower business, which is currently the subject of a takeover bid. Should it choose to sell, it will be able to book a US$20m profit. With election uncertainty out of the way, we believe the group’s property sales will start to pick up again.

K1 Ventures. K1 reported net profit exceeding S$80m in 1QFY16 due to the substantial payout received from its investee KUH. We believe the group will pay out this additional cash, which will translate to a S$0.04/share. Additional payout from KUH is also likely as and when cash is realized. We continue to see good risk-rewards in holding on the stock.

| ♦ Bringing in fresh ideas |

| ♦ The business environment continues to be difficult, both on the domestic front as well as for businesses that operate regionally. There were quite a few earnings misses in the 3Q reporting season, including some that swung into losses due to a combination of higher business costs coupled with weak pricing power. That said, we continue to see value in the market and continue to deploy our cash into new ideas. ♦ We now focus on China property plays. We note that recent news flow pointed towards a heating up property market in China. New home prices grew for a fifth consecutive month in September, rising 0.3% from August. Most notably, Overall tier-one cities recorded annual price growth of 13.9%, up from 10.4% in August. New property prices in Shenzhen, home to the hottest of the hot stock markets up until June, recorded price surge of 37.6% YoY. Shanghai jumped by 8.3% YoY while those in the capital – Beijing – increased by 4.7% YoY. Furthermore, the ongoing loosening of monetary policy along with the introduction of 2-child policy should serves as positive catalysts for Chinese property stocks. While Chinese property plays listed in A-share and Hong Kong have already reacted positively towards these news and rally, Singapore’s Chinese property names have not responded to all these positive news flow, presenting opportunity for value investors.  Yanlord "boasts a strong brand name especially in the high-end market segment along with a solid balance sheet and high-quality investment properties portfolio."♦ Hence, we introduce Yanlord as the latest addition to our model portfolio given its strong positioning in the tier-one and tier-two cities of China. It boasts a strong brand name especially in the high-end market segment along with a solid balance sheet and high-quality investment properties portfolio. The stock is trading at a steep discount of 49%% to RNAV estimates (SGD2.13) by market consensus. Yanlord "boasts a strong brand name especially in the high-end market segment along with a solid balance sheet and high-quality investment properties portfolio."♦ Hence, we introduce Yanlord as the latest addition to our model portfolio given its strong positioning in the tier-one and tier-two cities of China. It boasts a strong brand name especially in the high-end market segment along with a solid balance sheet and high-quality investment properties portfolio. The stock is trading at a steep discount of 49%% to RNAV estimates (SGD2.13) by market consensus. For 9M2015, Yanlord recognized 50% YoY jump in revenue to CNY6.3bnm achieved contracted sales of CNY20.3bn (book through 4Q15 to 2017), up 220% YoY, exceeding its 2015 sales target of CNY18.0bn and accumulated pre-sales pending recognition of CNY24.2bn, ensuring strong earnings visibility. Our channel checks show that they are likely to achieve well beyond its revised target of CNY25bn of contract sales for 2015. We expect 1) stellar results for the subsequent quarters, 2) redemption of the high-yield bond (10.6%, SGD400m) and new project acquisition possibly in the area of Suzhou and Tianjin to be the strong catalysts for share price. ♦ We also add First Sponsor Group, a real estate group undertaking mixed development projects in Chengdu and Dongguan. First Sponsor has healthy presales from its Millennium Waterfront Chengdu project which will underpin its earnings for the next few years. In addition, the group has a lucrative property financing business, which generate earnings of ~S$30m per annum. First Sponsor is leveraging on its strong balance sheet and parentage (with City Developments and Tai Tak Group as its major shareholders) to expand into the Netherlands, building a portfolio of prime office assets there with strong yields. |

Full report here.