Excerpts from analysts' report

CIMB analysts: Roy Chen & William Tng, CFA

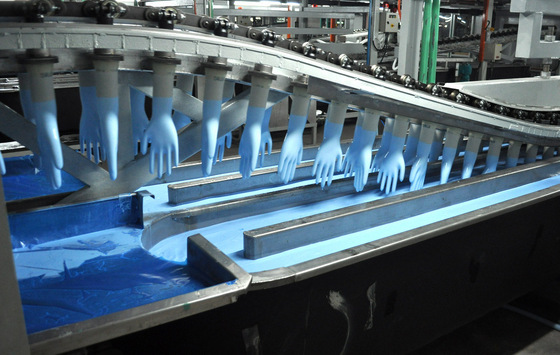

Riverstone Holdings : Good project execution  By early next month (Nov), Phase 2 will be in full production. NextInsight file photo. By early next month (Nov), Phase 2 will be in full production. NextInsight file photo.■ Riverstone’s production capacity would expand 24% to 5.2bn pieces p.a. upon the completion of phase II expansion by end-15 (end-14: 4.2bn). ■ Group-level capacity utilisation rate is at optimal level of c.90%. Phase III expansion (additional 1bn capacity) is slated to commence operations in 3Q16. ■ The cleanroom segment would benefit from strengthened US$ and low raw material costs, while the healthcare segment would pass benefits on to customers. ■ Upgrade Riverstone from Hold to Add, with higher target price of S$1.92 |

Site visit to Riverstone factory in Taiping, Malaysia

On 9 Oct 2015, we participated in a day trip organised by Riverstone to its production facilities in Taiping, Malaysia. To recap, Riverstone plans to develop the site in several phases in 2014-18 (adding capacity of 1bn pieces p.a. per phase). When fully developed, the site would accommodate a total capacity of c.5bn pieces p.a., raising Riverstone’s total capacity to 8.2bn pieces p.a. Phase I was completed in FY14.

Phase II capacity to commence full production by end-15

Phase II expansion comprises two single lines and four double lines. Each single line is able to produce c.10m pieces of gloves per month and each double line can produce c.20m pieces per month. To date, two single and two double lines have commenced operations and the remaining two double lines are slated to go onstream by early-Nov. When completed, phase II would raise Riverstone’s total capacity to 5.2bn pieces p.a.

New capacity fully taken up, launching phase III in FY16

Management guided that the additional capacity of 1bn pieces from phase II has been fully taken up by orders from its existing and new customers. Riverstone’s group-level capacity utilisation rate is c.90%, close to optimal operating efficiency.

"Upgrade from Hold to Add, with higher target price of S$1.92 "Upgrade from Hold to Add, with higher target price of S$1.92We raise our FY15-17F core EPS forecasts by 2.2-10.0% to reflect slower margin normalisation due to the continued strengthening of the US$ against the RM, as well as the benign raw material prices. "Our new target price of S$1.92 is based on 18.7x CY16 P/E (still pegged to the Malaysian peers’ average). We expect Riverstone to command a 3-year EPS CAGR of 17.9% in FY15-17, driven by capacity expansion during the period." -- Roy Chen (photo) and William Tng, CFA |

As such, management has decided to proceed with phase III expansion. The factory building is due to be completed in Mar 2016 and phase III would commence production in 3Q16.

Outlook buoyed by favourable FX and raw material prices

While Riverstone has to surrender the benefits from favourable FX and low raw material costs to its customers in the more generic healthcare gloves segment due to keen competition, the group’s cleanroom segment (c.50% of FY14 group sales) gets to keep the benefits.

Unlike healthcare gloves that are priced based on a standard formula, cleanroom gloves are priced on negotiation basis and Riverstone’s 60% share of this niche market gives it more bargaining power.