Excerpts from analyst's report

KGI Fraser analyst: Renfred Tay

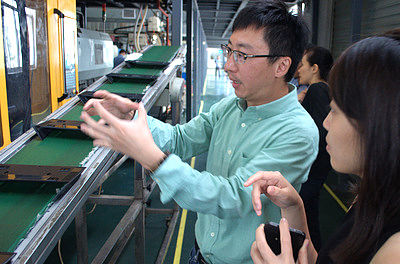

| Consumer electronics to the rescue A visit to Memtech's Dongguan factory. We paid a visit to Memtech's factory in Dongguan on Tuesday. Memtech had consolidated its operations in this part of China last year into a single subsidiary. This has brought about some cost savings, lower tax rate and greater internal efficiencies. The factory is the smallest of its three sites in China and employs about 1,700 workers at the moment; compared to 1,100 in Kunshan and 1,800 in Nantong.  Memtech executive director TM Chuang. NextInsight file photo.Like the Kunshan factory, the bulk of the products from Dongguan are for consumer electronics (50%) and telecommunication products (30%). Memtech executive director TM Chuang. NextInsight file photo.Like the Kunshan factory, the bulk of the products from Dongguan are for consumer electronics (50%) and telecommunication products (30%). The production utilization rate for Dongguan is currently at about 80%. This corroborated with our observations, when we roughly counted the number of machines being utilized during our walkabout. We were also told, by the general manager, that this quarter’s utilization rate is higher than the previous quarter (2Q15); while the next quarter’s (4Q15) utilization rate should be slightly higher than the current one (3Q15). |

3Q results expected to be better than 2Q. Memtech's 3Q results should improve over 2Q's (likely to be the weakest for this year). We mentioned in our previous update that there were some order delays by Memtech's automotive customers during 2Q; some of these orders have resumed and these customers' forecasts to Memtech have remain unchanged.

Memtech’s 3Q results could also be boosted by the consumer electronics segment with strong orders being placed by Amazon in preparation for the year‐end shopping season. We saw quite a number of Amazon product components being made during our plant visit.

beats by Dr. Dre, the world's best selling headphones brand, is now Memtech's newest customer. The company won the approval from beats recently for a next generation headphone product. We spotted the tools being built for this particular product during our visit at the Dongguan factory’s tooling department. Production is expected to begin in early 1Q16.

Maintain BUY with unchanged TP. Given Memtech’s optiistic outlook for 3Q and the plans for new products to be introduced, we keep our BUY rating for Memtech. We make no changes to our forecasts at this juncture and keep our target price of S$0.145 (pegged at 11x FY15F P/E) unchanged.