Excerpts from analyst report

|

UOB KH analyst: Tan Shuo Han |

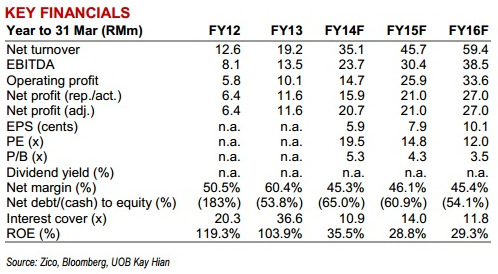

Zico Holdings MD Chew Seng Kok. Screenshot from YouTube.♦ We initiate coverage on Zico with a conviction BUY call and a target price of S$0.57 based on a two-stage DCF model with cost of equity of 7.6% and terminal growth of 2%, which implies a FY15F PE of 19x.

Zico Holdings MD Chew Seng Kok. Screenshot from YouTube.♦ We initiate coverage on Zico with a conviction BUY call and a target price of S$0.57 based on a two-stage DCF model with cost of equity of 7.6% and terminal growth of 2%, which implies a FY15F PE of 19x. We think this valuation is fair given that the company: a) is more profitable than its peers with its higher margins and ROEs, b) has a stronger growth trajectory

♦ A unique multi-disciplinary and integrated services play. In the ASEAN region, Zico is the first legal and Shariah-compliant advisory firm to list and its valuation deserves a scarcity premium.

In our opinion, a further upward rerating of the stock’s multiples will be driven by the stock’s one-of-a-kind exposure to the fast-growing legal and professional services market.

♦ Combining network advantage with high returns. Zico’s model combines a high return on capital, high-margin business with a willingness to re-invest cash into accretive acquisitions. We feel Zico’s aggressive M&A strategy will allow it to consolidate a fragmented market comprising smaller competitors without the same access to capital and to deepen its competitive moat.

In our opinion, Zico has the potential to grow into a powerful presence in the ASEAN region and emerge as a genuine challenger to the big accounting firms as an integrated provider of professional and legal services. Slater & Gordon’s success in Australia and the UK has shown that buyouts of smaller rivals can be a highly value-enchancing strategy for shareholders.

♦ A focus on ASEAN. Zico’s active but disciplined approach to bolt-on acquisitions emphasises: a) businesses with efficient operations, b) suitability of integration into the Zico network, and c) an ASEAN presence. We think their concentration on the ASEAN region will be especially lucrative for the company, given the favourable structural growth of ASEAN and the implementation of the ASEAN Economic Community from 2015.