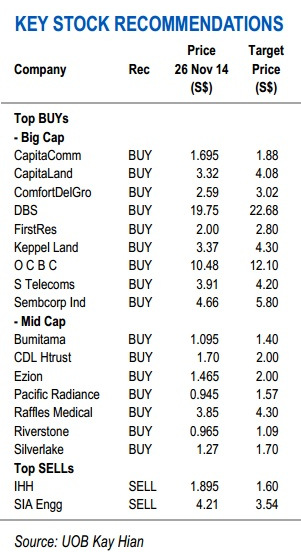

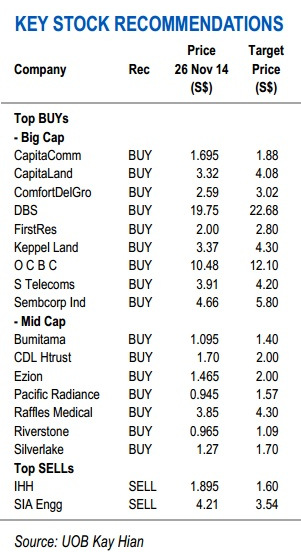

Excerpts from UOB Kay Hian's 123-page report Sectors on our OVERWEIGHT list include banks, property and telecommunications.

Sectors on our OVERWEIGHT list include banks, property and telecommunications. Banks are attractively valued and have been consistently delivering earnings. Rising interest rates will also benefit banks, which have enjoyed a recovery in NIM (net interest margin) since 4Q13. Banks with a solid CASA (current account, savings account) franchise such as DBS and OCBC will be the strongest beneficiary of rising rates. These two are our top picks with target prices of S$22.68 for

DBS and S$12.10 for

OCBC.

» We OVERWEIGHT the property sector and prefer developers over S-REITs on a one-year horizon. We think investors have over-discounted the expected fall in physical residential property prices (of up to 40-50%) as share price discounts to RNAVs have expanded to 41%.

Share prices of developers could re-rate once there are indications that physical property prices are unlikely to correct more than 10-15% on average. On our BUY list are CapitaLand, Keppel Land and Wing Tai.

» We are selective on S-REITs with a preference for office and hospitality S-REITs. We think growth expectations will outweigh concerns over rising interest rates. Office rental rates are expected to rise 10-15% and should support rental growth. Hospitality S-REITs also look compelling as RevPARs are expected to turn around from 2015 (3-4% unlevered yields).

|

ComfortDelGro: Recent price $2.62. Target price $3.02. ComfortDelGro: Recent price $2.62. Target price $3.02.

NextInsight file photo» While the land transport sector has outperformed the FSSTI, we think its earnings resilience and strong operating cash flows, particularly for CD, are attractive. Also, with the impending restructuring of the railway sector, the sector is likely to remain buoyant. Our top pick is CD (ComfortDelGro) with a DCF-based target price of S$3.02.

» Within the offshore & marine sector (O&M), we have an OVERWEIGHT stance on oil services and MARKET WEIGHT call on shipyards. While sentiment has clearly been dampened by weaker oil prices, we believe there are selective opportunities after the recent selldown.

We advocate a bottom-up strategy and prefer companies with: a) experienced management, b) good balance sheet, c) clearly-defined expansion strategy, and d) other areas such as regional footprints and company-driven growth.

Our key picks include Ezion, Pacific Radiance and Triyards.

»Telecommunications is favoured for its defensive qualities. While subscriber growth has eased domestically, increasing data usage and tiered data plans are expected to augment growth. Also, we think the low gearing levels of the various telco companies could also see potential upside for special dividends over the longer term. Our BUYs include SingTel and M1.

» We UNDERWEIGHT aviation support services as the sector has been plagued by rising labour costs and growing competitive pressures. SELL SIAEC as near-term cost pressures are unlikely to abate soon. Our preferred stock is SATS.

|

Sectors on our OVERWEIGHT list include banks, property and telecommunications.

Sectors on our OVERWEIGHT list include banks, property and telecommunications.