|

|

Jiurui E’way acquisition provides immediate boost. By restructuring the loans of Jiurui Expressway (borrowing offshore at less than 3% interest to repay onshore loans at over 6% interest), we expect Jiurui Expressway to begin making a small but positive contribution of c. HK$20m to the CMHP’s bottom line in 2015, while providing firm long term earnings growth prospects for the Group.

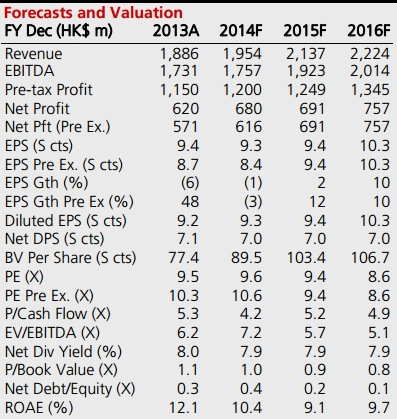

Source of all data: Company, DBS Bank, Bloomberg Finance L.P Potential for debt-financed acquisitions upon CB conversion. Assuming the convertible bonds are fully converted in 2015 (well in the money with a conversion price of S$0.826), the Group’s net gearing will stand at just 0.18x by end 2015.

Source of all data: Company, DBS Bank, Bloomberg Finance L.P Potential for debt-financed acquisitions upon CB conversion. Assuming the convertible bonds are fully converted in 2015 (well in the money with a conversion price of S$0.826), the Group’s net gearing will stand at just 0.18x by end 2015. This gives the Group debt-headroom for acquisition deals of between Rmb 2.5bn to Rmb4bn (which would take FY15 net gearing to c. 0.5x to 0.7x), compared to an enterprise value of c. Rmb2.8bn for the Jiurui Expressway deal.

CMHP can easily pay 7Scts in dividends p.a. even when all the CBs are converted, translating to just over 70% payout.

Valuation undemanding at less than 10x FY15F PE and 7.9% dividend yield. We raise our DCF-based TP (10% WACC) to S$1.42 to factor in the Jiurui E’way acquisition, with further upside potential if the Group can make more value accretive toll road acquisitions.

Recent story: 10 stocks with catalysts: QT VASCULAR, SWISSCO, CHINA MERCHANTS, etc