This article was recently published on http://www.drwealth.com and is republished with permission. Calvin Yeo (left) is the Managing Director of Doctor Wealth Pte Ltd (www.DrWealth.com) which is an online personal finance platform that aims to provide self service financial tools and financial education. He is also a Chartered Financial Analyst (CFA) as well as Certified Financial Planner (CFP).

This article was recently published on http://www.drwealth.com and is republished with permission. Calvin Yeo (left) is the Managing Director of Doctor Wealth Pte Ltd (www.DrWealth.com) which is an online personal finance platform that aims to provide self service financial tools and financial education. He is also a Chartered Financial Analyst (CFA) as well as Certified Financial Planner (CFP).

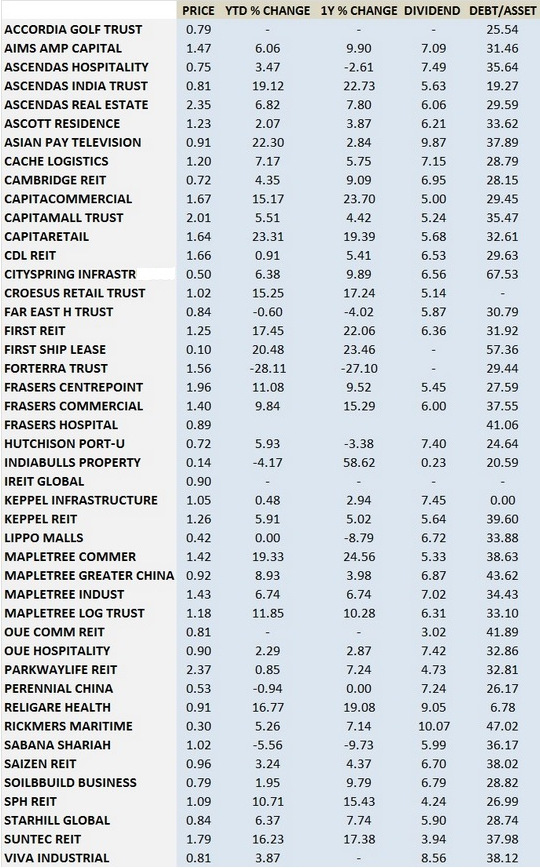

A LARGE PART of evaluating REITs and business trusts is to look at their dividend yields relative to their peers as well as the past trends. We will look at an update of the REITs and business trusts latest dividend yields.

Looking at the above chart, it is quite apparent that business trusts in general have much higher dividend yields than SREITs. Does that mean they are better? Not really, business trusts are different from SREITs in terms of the structure, see Differences Between REITs and Business Trusts.

REIT rental income generally tends to be quite stable especially for retail and healthcare. Business Trusts however, depends on the assets which can vary widely from ships to utilities, ports and so on.

Another trend which you would notice is that some business trusts tend to have very high leverage as well. Cityspring – 67.5%, First Ship Lease – 57.3% etc, while most REITs are generally 30-40+%. That puts them at higher risk levels, especially if the assets are depreciating in nature like ships.

Historical Performance of SREITs

The FTSE Straits Times Real Estate Investment Trust Index is up 7.2 % year to date. The dividend yield is currently at 6.16%, but hit as high as close to 14% during the 2008 crisis. The yields went as low as 4+% prior to the crisis. Back in 2012, the yield was pretty close to 5% as REIT prices rose dramatically. However, this is overall index yield, individual yields may yet show interesting stock picks.

|

|

Previous story: CALVIN YEO: "I've bought more REITS and other dividend stocks"