Excerpts from analysts' reports

NRA Capital maintains 'overweight' call on Chip Eng Seng and $1.04 fair value

Analyst: Joel Ng

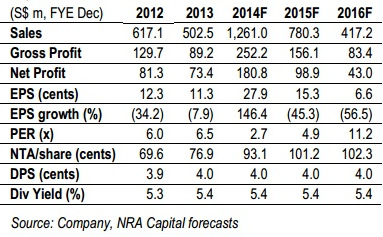

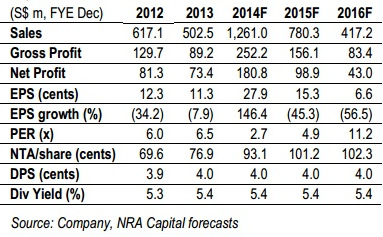

(left)Maintain forecasts and recommendation. We maintain our estimates and fair value at S$1.04 given that results were in line, still based on our SOTP of its property development and construction business.

We value its construction business at 6x FY14 PER, in line with its peers in the construction sector.

Meanwhile, we apply a 30% discount to RNAV (property development, property investments and hotel).

With a 39% potential upside and an attractive 5.3% dividend yield, maintain overweight.

The bulk of revenues is in 2H14. So far, it has mainly recognised 100 Pasir Panjang (around 77% sold as at end 1Q14) in its 1Q14, leaving Belysa, Belvia and Alexandra Central to be recognised in subsequent quarters (the three developments are at least 97% sold as at end 1Q14).

The group expects TOP for Belysa in 2Q14, while Belvia and Alexandra in 2H14.

As Belysa is a JV, it will recognise 40% of profits directly in its income statement.

Recent story: @ Chip Eng Seng's AGM: Update on happenings in Australia and S'pore

|

CIMB says takeover offer for Goodpack "not fantastic, but a fair deal"

Analysts: Jessalynn Chen and Kenneth Ng, CFA (left) Analysts: Jessalynn Chen and Kenneth Ng, CFA (left)

We believe that KKR’s offer to buy Goodpack for S$1.4bn is fair, although investors may have been hoping for a higher offer price given that:

1) its closest listed competitor, Brambles, trades at a higher P/E multiple, and 2) the offer price only represents a 7% premium over the prior closing price.

However, we think that investors have already largely priced in a takeover scenario.

If the deal fails to materialise, we expect the stock to trace back to the S$1.90-2.00 levels it was trading at prior to news of a potential takeover offer (13x-14x FY15 P/E).

Due to limited upside to the offer price, we downgrade the stock to Hold from Add. Our target price is unchanged at S$2.51, based on 15x FY16 P/E (7-year mean).

|

Analyst: Joel Ng (left)

Analyst: Joel Ng (left) With a 39% potential upside and an attractive 5.3% dividend yield, maintain overweight.

With a 39% potential upside and an attractive 5.3% dividend yield, maintain overweight.