Youyuan CFO Sam Wong speaking to investors. Photo: Aries ConsultingHSBC: YOUYUAN kept ‘Overweight’

Youyuan CFO Sam Wong speaking to investors. Photo: Aries ConsultingHSBC: YOUYUAN kept ‘Overweight’

HSBC said it is reiterating its “Overweight” recommendation on paper play Youyuan International (HK: 2268) with a target price of 2.9 hkd (recent share price 2.40).

HSBC expects interim net profit to grow 11.5% y-o-y to 136.9 mln yuan, mainly driven by an 18.8% growth in sales volume.

“However, we expect a higher effective tax rate at 22% in 1H13 (last year: 15.4%) due to the expiry of a tax holiday for two factories,” HSBC said.

The research house said it continues to like Youyuan as it enjoys a cost advantage over its competitors through the use of de-inked pulp, and is beginning to expand into wallpaper production.

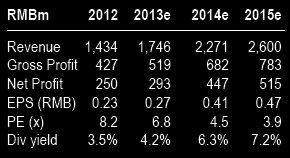

Source: HSBC“During periods of rising wood pulp prices, Youyuan’s cost advantage is more apparent.”

Source: HSBC“During periods of rising wood pulp prices, Youyuan’s cost advantage is more apparent.”

Youyuan remains a value play, HSBC added, trading at a 2013e PE of 6.8x, with a dividend yield of 4.2%.

“We believe the results announcement in August will be a catalyst due to expected solid numbers and an interim dividend,” the research note said.

Major applications for Youyuan’s products include gift wrapping, shoebox filler, fresh fruit wrapping, among many others, with the Hong Kong-listed firm marketing wrapping tissue paper under its “Youlanfa” brand and copy paper under the “Scholar,” “Young Scholar” and “Prodigy” brands.

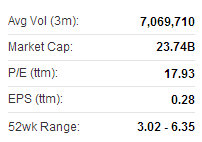

Youyuan is recently trading at 2.40 hkd with a 52-week range of 1.29-2.93.

Youyuan is recently trading at 2.40 hkd with a 52-week range of 1.29-2.93.

Source: Yahoo Finance

Youyuan production facilities are located in Xibin Industrial Zone, Jinjiang City, Fujian Province, PRC, and is always on the lookout for attractive pickups to boost production capacity and market share.

Deutsche: LEE & MAN reinstated ‘Hold’

Deutsche Bank said it is reinstating coverage of Lee & Man Paper (HK: 2314) with a “Hold” recommendation and target price of 4.62 hkd (recent share price 5.16).

Lee & Man recently 5.16 hkd“Amongst the paper names, we prefer Lee & Man to Nine Dragons Paper (HK: 2689) given its more defensive nature with higher ROE, better product mix, lower debt and better operating cashflow,” Deutsche said.

Lee & Man recently 5.16 hkd“Amongst the paper names, we prefer Lee & Man to Nine Dragons Paper (HK: 2689) given its more defensive nature with higher ROE, better product mix, lower debt and better operating cashflow,” Deutsche said.

However, the German research house noted that downstream demand for containerboard remains weak, dragged by disappointing exports.

“Given the high inventory/sales ratio of box makers, price hikes will be difficult.”

Deutsche Bank believes poor visibility of a 2014 recovery will continue to depress valuations.