ABCI: ANXIN-CHINA ‘Attractive’ P/E

ABC International said it likes Anxin-China (HK: 1149) among China’s cutting-edge security and safety monitoring technology firms.

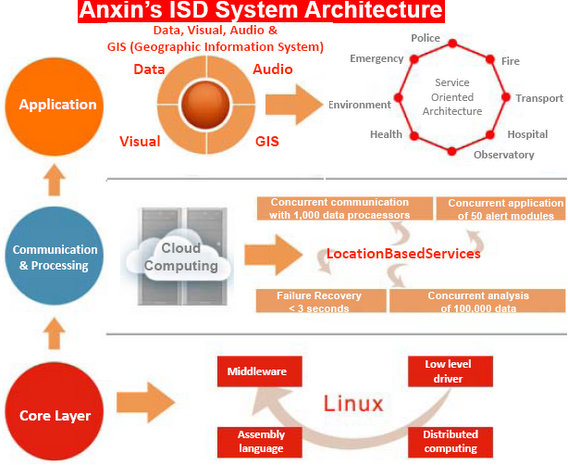

“Anxin-China is a promising ISS (“Intelligent Safety Systems”) and ISD (“Intelligent Surveillance, Disaster Alert and Rescue Coordination”) provider in China and is a leading systems provider in the production safety industry,” ABCI said.

The Hong Kong-listed firm provides both ISS and ISD services and products to governments and enterprises across China.

“The group applies ‘Internet-of-things’ technology to link up work sites and monitoring centers. The ISD market in various industries is largely untapped and has tremendous growth potential and we expect Anxin-China to benefit from this new market trend.”

It is estimated that over one million surveillance points both in China’s coal mining and multi-industry markets need monitoring equipment.

“Around 70% of the coal mining ISD market is still untapped; while the multi-industry ISD markets are almost entirely untapped,” the research house said.

ABCI said Anxin-China has developed a solid research team with broad knowledge across industries and can meet demands from several sectors.

“Anxin-China entered into a strategic partnership with Infinity Group, an Israeli PE firm with strong property resources and broad relationships with China’s local governments and the China Development Bank.”

The note added that Anxin-China has established credible business track records with local governments which are crucial to new business development.

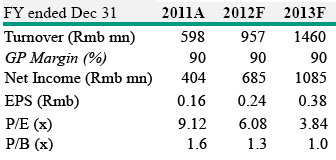

“The valuation looks attractive, with the counter’s 2013F P/E and P/B at 3.84 and 1.0, respectively.”

Yifeng: HILONG Target Hiked to 3.05 hkd

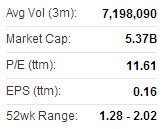

Yifeng Finance said it is raising its target price on oilfield products play Hilong Holding (HK 1623) to 3.05 hkd from 2.30 (recent share price 2.73).

“Hilong has an attractive valuation for a high-barrier business. We raise the price target as drill pipes and oilfield services sectors re-rate on improving fundamentals and better sentiment,” Yifeng said.

The research note added that it believed the target PER expansion to 10.0x from c.8.0x is supported by steady 2012-2014E EPS growth of 15%, above-average RoE of 17% and good yield of 3.5-4.0%.

“The strategic supplier cooperation agreement recently signed with Sinopec underscores Hilong's leadership in drill pipes -- it should gain better access and insight into Sinopec's programs.

“We like Hilong's exposure to drill pipes and coating segments, which have higher entry barriers and offer healthy margins.”

Kingston: HILONG Gets 2.9 hkd TP

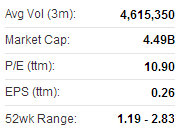

Kingston Research said it is setting its target price for oilfield products supplier Hilong Holding (HK: 1623) at 2.9 hkd (recent share price 2.73).

The research house has a buy-in price of 2.6 hkd, a stop-loss of 2.45, and a “Buy” recommendation on the Hong Kong-listed energy sector firm.

“Hilong is the largest coating services and drill pipe manufacturer in China. It signed a long-term strategic supply deal with Sinopec (HK: 386) in early December for drill pipe products, further strengthening the group's leading position in China,” said Kingston.

Hilong was recently awarded six orders by the No.3 drilling firm in Canada -- Trinidad Drilling (CN: TDG) -- for its drill rig supporting products and supplementary drill pipes.

The acquisition completed in 2011 for Hilong Petroleum Pipe has commenced mass production and its estimated annual capacity contribution is 10,000 tonnes.

“The group is hoping to increase the revenue contribution from overseas to above 50%,” Kingston said, adding that ASPs are expected to increase as demand for drill pipes and related products improve.”

See also:

ANXIN-CHINA: Making Security Securities Sexy

HILONG: No.1 In China, No.2 Globally; Sinopec Contract Key

Energy Spurt: NEW OCEAN Target Hiked, HILONG 'Outperform', PETROCHINA & SINOPEC Both ‘Buys’

Stepping On The Gas: NEW OCEAN ‘Buy’, CNOOC/KUNLUN Top Picks