HL Tiong says he is an average Singaporean in his early 30s, has a full-time job, is happily married and caught within the sandwich class. He lives in an executive condominium with a "mountain-like mortgage". "My goal is to achieve financial freedom as early as I can. My target is 45 years old. I don't mind working but I hope to provide my wife an option not to work." The following article was recently published on his blog (http://reaching4financialfreedom.blogspot.sg/) and is republished with permission.

THANKS TO A reader for bringing to my attention Jason Marine Group.

In the email, Jason Marine is described as a net-net stock that has been paying dividends for the past 3 years, has a dividend yield of 1.33%, carries no debt, and its level of cash is more than its market capitalisation.

Introduction: "Jason Marine Group Ltd. designs, integrates, installs, and tests marine communications, navigation and automation systems; and maintains and supports those systems." - Bloomberg

Now, let's see if Jason is the real deal.

Snapshot of Jason Marine's fundamentals :

(a) Benjamin Graham net-net? For the uninitiated, Ben Graham is the "grand-daddy" of value investing. He popularised the value investing concept of net-net.

(a) Benjamin Graham net-net? For the uninitiated, Ben Graham is the "grand-daddy" of value investing. He popularised the value investing concept of net-net.

A net-net stock is one whose market capitalisation is lower than its current assets minus total liabilities.

As at 11 Nov, Jason Marine's market capitalisation was S$15.9 million. Based on its latest FY14 1H results announcement, Jason Marine's current assets totalled S$37 million.

Minusing total liabilities of S$14.6 million, Jason Marine's net-net value was S$22.4 million.

Strictly speaking, if we stick to the details laid out in Part IV - Balance-sheet Analysis in Ben Graham & David Dodd's investment classic "Security Analysis", we should also take a discount off trade receivables (assuming some of which is not recoverable) and provide for some obsolescence in inventory levels.

While the degree of discount to apply is subjective, the revised net-net value will likely still be higher than 15 cents per share.

More importantly, being a net-net does not automatically make it an attractive prospect. The converse is true too.

Jason Marine's stock price has traded in a tight range since April 2011. Chart: Bloomberg

Jason Marine's stock price has traded in a tight range since April 2011. Chart: Bloomberg

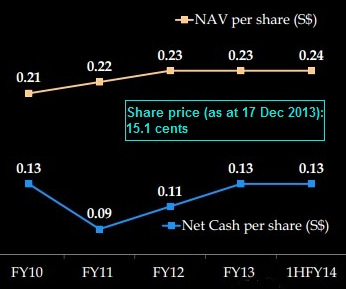

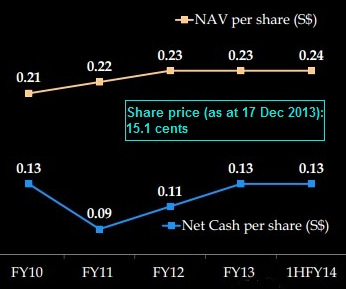

Jason Marine's net asset value (NAV) is 24.18 cents. The last traded price of 15 cents presents a 38% discount off NAV.

Jason Marine might be cheap if it is liquidated tomorrow but to buy-and-hold, we need to be convinced that it has a sustainable business model - one that can generate free cash flows year on year.

I am a great believer in prices eventually tracking fundamentals. Let's move on to the next aspect.

(b) Low dividend yield - Jason Marine paid out 0.2 cents in Aug, which gives it a 1.33% dividend yield.

Not exciting, but since Jason Marine positions itself as a growth stock, retaining a higher amount of cash to sustain growth plans is justifiable.

The issue is not the low dividend yield. We need to be comfortable with two things:

(1) its ability to deliver the growth story and (2) rationale for huge cash levels.

As at 30 Sep, Jason Marine's cash levels total S$14.2 million, or 13.3 cents. That is 89% of the last traded price!

Surely you can't go wrong with that, could you? Well...

(c) Huge cash levels - there are several ways to look at Jason Marine's huge cash hoard.

Is it a result of huge working capital needs (which makes sense why management wants to hoard it, but may signify a business which is capital intensive), is it a result of un-utilised IPO proceeds, or a result of borrowings?

Let's start with the last one. Fabulous, it's not borrowings. Jason Marine has none.

I will be honest, I am a sucker for companies without any debt. I know I am starting to sound like Walter Schloss but I can't help it.

I have seen too many examples of companies which played excessively with leverage and ended up destroying shareholder value.

Having said that, not all companies without debt are good. I would prefer a company which takes on some debt and overall is making money to a company which is debt free but making losses.

The former can turn good if it resolves the debt problems. The latter makes me wonder if it's a good business at all to start with.

To that end, Jason Marine sends me mixed signals. Based on its latest announcement, if we extrapolate earnings to the full year, estimated earnings are S$2.2 million.

This represents a 5.5% return on assets, which is decent.

But Jason Marine has not delivered such results since listing.

Forward looking prospects? Well, management makes it clear prospects are dim.

"The overall operating conditions remain difficult against a backdrop of weak demand, intense price competition and rising costs, especially that of labour. As the outlook of the market is still uncertain, the Group remains cautious on the operating environment for the second half of the financial year."

(d) Utilisation of IPO proceeds - Jason Marine was listed on Catalist in Oct'09, raising S$2.1 million in the process. As at 30 Sep, Jason Marine still has S$1.1 million IPO proceeds un-utilised.

Usually in the IPO prospectus, the Company will state how it is going to utilise the IPO proceeds and this is heavily linked to the growth story painted in the same document.

4 years have since passed. Does this present an indication of management's execution ability?

Going forward, every time management reduces cash and commit it to something (new investment), we should scrutinise it carefully.

So far, I am unconvinced of management's ability to allocate capital well to generate shareholder value.

Wrapping Up

To sum up, I think Jason Marine is an interesting stock. The market has a depressed view on it and its price reflects the pessimism.

Would Jason Marine continue its turnaround story and travel the growth path? A lot has to do with management's execution ability. So far the results are spotty and management seems very cautious on outlook.

Don't get me wrong, I like net-nets. But I am always skeptical of my initial optimism about stocks.

I have to be skeptical because I regularly look into rubbish chutes for gold (see my 52 week low analysis). More often than not, I find more rubbish than gold.

Since cognitively I have been wired to try and find gold, my enthusiasm might cause me to come to a quick and easy conclusion that something is a gem when it may not be.

Hence I force myself to do more research before buying.

This process calms me down and keeps me sane. But it also means I don't find many opportunities. Most stocks don't look that great to me.

So much for my 2 cents worth. There's a fair bit of good discussion on Jason Marine at the Valuebuddies forum, so please do take a look.

Well-respected valuebuddy dydx shared generously on the stock. There is also a good net-net blog post on Jason Marine (pretty much is the positive spin).

Hope the above helps, wish you happy investing!

(a) Benjamin Graham net-net? For the uninitiated, Ben Graham is the "grand-daddy" of value investing. He popularised the value investing concept of net-net.

(a) Benjamin Graham net-net? For the uninitiated, Ben Graham is the "grand-daddy" of value investing. He popularised the value investing concept of net-net.  Jason Marine's stock price has traded in a tight range since April 2011. Chart: Bloomberg

Jason Marine's stock price has traded in a tight range since April 2011. Chart: Bloomberg

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors