Executive chairman Zhou Jun. NextInsight file photoHERE'S a water stock that has been capturing investors' attention of late -- SIIC Environment Holdings.

Executive chairman Zhou Jun. NextInsight file photoHERE'S a water stock that has been capturing investors' attention of late -- SIIC Environment Holdings.

Since Sept this year, its stock price has shot up 70% -- from 8 cents to 13.6 cents today.

Today, it jumped 12.4%.

This was one day after it posted an increase of 62.0% year-on-year for its net profit attributable to shareholders to reach Rmb 118.8 million for 9M2013.

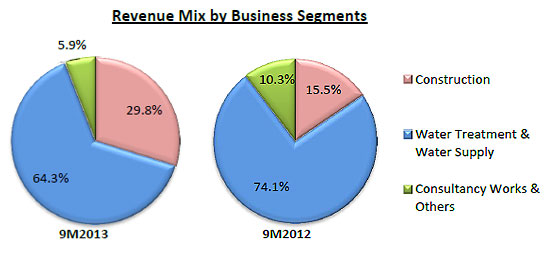

Revenue rose 48.8% to Rmb 777.9 million. There was a 185.7% increase in sales from construction to reach Rmb 232.2 million and 29.0% higher sales from water treatment and water supply to reach Rmb 499.9 million.

Finance income tripled to Rmb 142.9 million for 9M2013 primarily due to contribution from Nanfang Group in relation to financial income from service concession arrangements.

In addition, finance expenses increased 33.3% to Rmb 93.8 million largely due to contribution from Nanfang Group.

This caused gross margin to decline by 8.9 percentage points. Gross profit thus increased by a less than proportionate amount of 17.3% to Rmb 257.5 million.

Other than contribution from Nanfang Group (acquired in 3Q2012), the earnings boost was also due to higher financial income arising from service concession arrangement and reversal of allowance for doubtful receivables.

Nanfang Group has a business similar to SIIC Environment. It has more than 10 environmental protection projects in China with daily water treatment capacity of up to 1.17 million tons.

These projects include wastewater treatment, tap water treatment, reclaimed water treatment, project investment, operation and management of water treatment facilities.

The acquisition significantly expanded the Group’s geographical coverage and daily treatment capacity. The acquisition of plants already in operation increases revenue contribution from water tariffs, which is a more stable income source compared to construction of plants.

The acquisition of plants already in operation increases revenue contribution from water tariffs, which is a more stable income source compared to construction of plants.

The Group currently has daily water treatment capacity of 3.9 million tons with more than 40 water treatment projects and 1 waste incineration project in 12 provinces - Hubei, Shandong, Hunan, Zhejiang, Shanxi, Henan, Liaoning, Jiangsu, Yunan, Fujian, Guangdong and Guangxi.

In August, the company announced that it is paying about S$3.76 million to increase its interest in Nanfang by 3.11% to reach 76.42%.

”Our strategy is to grow organically through upgrade of facilities as well as via M&A. China’s water industry is fragmented and we hope to play a pivotal role by emerging as a sizable player through M&A,” said executive Chairman, Mr Zhou Jun.

SIIC Environment had a cash reserve of Rmb 473.3 million as at 30 September. To achieve its growth plans, it raised another S$260.2 million through a placement to 5 investors in October.

On the immediate horizon, the management intends to expand its waste management capabilities. The following acquisitions are in the pipeline:

(1) 70% in a wastewater treatment plant (Shanghai Qingpu Second Waste Water Treatment Plant Co Ltd) for Rmb 126 million.

(2) 50% in a waste processing plant (Shanghai Pucheng Thermal Power Energy Co Ltd) for Rmb 530 million.

"Strengthening our foothold in the waste-to-power sector is an important priority in our aim to be a fully integrated environmental player," said Mr Zhou. SIIC Environment has climbed steadily in the past 4 months. Bloomberg data

SIIC Environment has climbed steadily in the past 4 months. Bloomberg data

Recent story: SIIC ENVIRONMENT: Big Backers Fund M&A Strategy