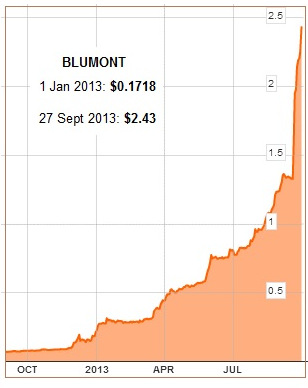

BLUMONT GROUP (fka Adroit Innovations) is the star sizzler stock of 2013, having surged from 17.18 cents at the start of the year to $2.43 recently. Its market cap is now S$4.2 billion.

One lucky investor had bought 500,000 shares in 2010 for $15,087 at 3.02 cents apiece, and now they are worth $1.18 million.

Hard to believe? There is a screenshot of of his account but it's too wide to fit into our webpage. You can view it by clicking here.

Here's a truncated version:

Certainly the stock has been on a crazy tear -- and the action happened just this year. Some forumers have ventured that the stock is cornered.

We are baffled as to why the stock has done so well and we won't venture into any discussion about its business fundamentals. You may read its 1H2013 results announcement on the SGX website.

For what it's worth, here is the story of one very lucky investor as reflected in several posts in SG Talk forum.

One lucky investor had bought 500,000 shares in 2010 for $15,087 at 3.02 cents apiece, and now they are worth $1.18 million.

Hard to believe? There is a screenshot of of his account but it's too wide to fit into our webpage. You can view it by clicking here.

Here's a truncated version:

Certainly the stock has been on a crazy tear -- and the action happened just this year. Some forumers have ventured that the stock is cornered.

We are baffled as to why the stock has done so well and we won't venture into any discussion about its business fundamentals. You may read its 1H2013 results announcement on the SGX website.

For what it's worth, here is the story of one very lucky investor as reflected in several posts in SG Talk forum.

Chart: Bloomberg

Chart: BloombergGameOver: Damm lucky now then realise this counter made 1million+ alr!

thanks! that's my father account, hope can share abit

Yin yang: Your father must be doing a lot of good...congrats!

honeybadger: if my portfolio appreciates 2-3X , i will be very contended. This is an exceptional case, the father is like a lucky star..

spider: threadstarter what's your father's next pick? do kindly share with fellow bros/sis here

GameOver: His picks only around 10% is accurate, he mostly anyhow buy. He just buy and put it there very long , he does not really care about how the market performs etc can 1 week login see one time those type, got some counters lose around 80% of its value. He just gave me a few of his accounts to trade and stop buying stocks anymore..he still got quite a number of stocks left. those who are really interested could pm me

sgbuyers: This company financial report looks very strange. Revenue only a few million a year but market cap a few billions. Better than china S-chips.

GameOver: its real.. he does not speak english don't really understand stocks much and dunno how to use brokerage accounts... just dug out this account and he ask me to use this to trade (and im the one who reset the pw of this acct) instead of the previous one has abit issue with the broker...

thanks! that's my father account, hope can share abit

Yin yang: Your father must be doing a lot of good...congrats!

honeybadger: if my portfolio appreciates 2-3X , i will be very contended. This is an exceptional case, the father is like a lucky star..

spider: threadstarter what's your father's next pick? do kindly share with fellow bros/sis here

GameOver: His picks only around 10% is accurate, he mostly anyhow buy. He just buy and put it there very long , he does not really care about how the market performs etc can 1 week login see one time those type, got some counters lose around 80% of its value. He just gave me a few of his accounts to trade and stop buying stocks anymore..he still got quite a number of stocks left. those who are really interested could pm me

sgbuyers: This company financial report looks very strange. Revenue only a few million a year but market cap a few billions. Better than china S-chips.

GameOver: its real.. he does not speak english don't really understand stocks much and dunno how to use brokerage accounts... just dug out this account and he ask me to use this to trade (and im the one who reset the pw of this acct) instead of the previous one has abit issue with the broker...

he still holding counters with big loss like falcon energy 500lots @ $0.66+ abit hard to advice him to sell off

Chinatownboy: I fully agree for a common layman investor, esp one who actively monitors the market, had be bought a stock low at sub 10c, high chances that he would have sold all or a substantial part of his holdings when the stock has appreciated multiple folds in the 40c, 50c range.

Unless the person 1) is or know an insider of the Company which he's supremely confident the stock would climb several folds higher within a few years 2) stopped trading or monitoring the market for a few years 3) takes a heavy gamble on the dream that the sky is the limit for the stock to surge.

I think luck and guts are a big factor. For myself I bought Blumont when it was Adroit between 8-10c. I sold progressively when it hit 40c to 1.80. Why I did so was cos the ghost of the last financial crisis kept haunting me. I remembered many of my pennies which had gains of 4-5 figures eroded in a matter of weeks, and in a few months down the road some of them were left trading below 10c. I still have a lil bit of Blumont left and will continue to take profit in small batches.

My profit is nothing to shout abt compared to TS' dad. I always try and psycho myself to be contented with whatever profits i made n not regret that I have sold at a much lower price. I try to tell myself what if the stock market does a big u turn one day, it could be déjà vu all over again. I can stomach risks but as I grow older I try not to take excessive risks.

Chinatownboy: I fully agree for a common layman investor, esp one who actively monitors the market, had be bought a stock low at sub 10c, high chances that he would have sold all or a substantial part of his holdings when the stock has appreciated multiple folds in the 40c, 50c range.

Unless the person 1) is or know an insider of the Company which he's supremely confident the stock would climb several folds higher within a few years 2) stopped trading or monitoring the market for a few years 3) takes a heavy gamble on the dream that the sky is the limit for the stock to surge.

I think luck and guts are a big factor. For myself I bought Blumont when it was Adroit between 8-10c. I sold progressively when it hit 40c to 1.80. Why I did so was cos the ghost of the last financial crisis kept haunting me. I remembered many of my pennies which had gains of 4-5 figures eroded in a matter of weeks, and in a few months down the road some of them were left trading below 10c. I still have a lil bit of Blumont left and will continue to take profit in small batches.

My profit is nothing to shout abt compared to TS' dad. I always try and psycho myself to be contented with whatever profits i made n not regret that I have sold at a much lower price. I try to tell myself what if the stock market does a big u turn one day, it could be déjà vu all over again. I can stomach risks but as I grow older I try not to take excessive risks.

Recently just announced:

AWARD OF CONTRACT WORTH APPROXIMATELY S$162 MILLION

The Board of Directors of Lian Beng Group Ltd (" the Company" , and together with its subsidiaries, the " Group" ) wishes to announce that its wholly-owned subsidiary, Lian Beng Construction (1988) Pte Ltd, has secured a contract through tender from Martin Modern Pte. Ltd. for the proposed condominium housing development comprising of 2 blocks of 30-storey condominium (total 450 units) with landscape deck, common basement carparks and communal facilities on lot 01590P TS21 at Martin Place (River Valley Planning Area) (the " Contract" ).

The Contract is worth approximately S$162 million. The contract period shall be 32 months and is expected to commence in September 2017.

The Contract is expected to have a positive financial impact on the net tangible assets per share and earning per share of the Group for the current financial year ending 31 May 2018.

As at 15 September 2017, the Group&rsquo s order book stood at approximately S$699 million which will provide a sustainable flow of activity through FY2020.

None of the Directors and controlling shareholders has any interest, direct or indirect, in the Contract.

BY ORDER OF THE BOARD

Cheers!

Most likely that is the case because rumours have it during the run up period that the counter had been cornered.