Swing Media completed in Jul 2012 the M&A of a solutions provider of solar-powered energy systems. The new unit has bagged deals from PetroChina and is set to boost Group profit. Swing Media completed in Jul 2012 the M&A of a solutions provider of solar-powered energy systems. The new unit has bagged deals from PetroChina and is set to boost Group profit. |

AFTER LANGUISHING for more than a year, shares of Swing Media Technology are back into action this year.

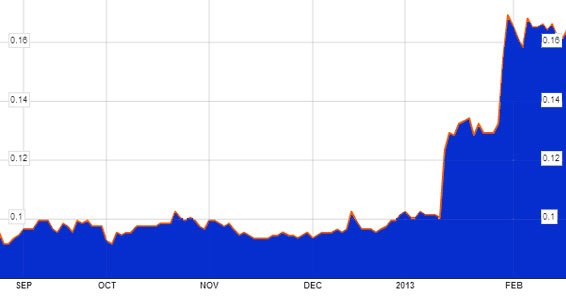

From trading at around 10 cents for the larger part of 2012, the stock has gained some 60% to about 16 cents currently, and all within a short span of three weeks.

The core business of Swing Media, a Hong Kong company listed in Singapore, is the manufacture and trading of data storage discs such as CD-R, DVD-R and related peripherals.

But it is its initial success into solar-powered energy systems that has been grabbing the attention of investors.

|

|

| 'Our solar business is an asset-light business,' said CEO Matthew Hui. Photo by Sim Kih |

“We intend to retain our CD-R and DVD-R business now that the industry consolidation is over. However, this core business is mature and we are seeking to diversify into growth areas like solar power,” said CEO Matthew Hui during an exclusive interview with NextInsight recently.

Globally, there is less demand for CD-R and DVD-R discs. This business is stable now that there are fewer suppliers in the industry post-consolidation.

"Demand for CD-R and DVD-R discs is mainly from developing nations. China contributes 60% to 70% of Group revenue. We are also exporting to South America and developing Asian nations," he said.

PetroChina deal getting investors excited

In 1H2013 (Apr to Sep 2012), Swing Media generated net profit of HK$32.6 million (about S$5.2 million), up 1.2% year-on-year.

What was interesting, though, was the Rmb 500,000 (about S$100,000) maiden profit contribution from its new green-tech subsidiary.

This profit came from installation of solar-powered energy systems at five PetroChina petrol stations.

The profit was recognized in 1H2013 after Swing Media’s acquisition of Shanghai Hui Yang New Energy Technology was completed in July 2012.

12.2 million new shares (3.29%) in Swing Media were issued at 9.73655 cents per share as purchase consideration (about S$1.2 million) for the green-tech unit.

While Rmb 500,000 for 5 petrol stations is not a big amount, it significantly represents only one percent of orders that the unit has secured.

| How much will the Solar-Powered Energy Systems contribute? Net profit per station = Rmb 100,000 Profit for 500 stations = 500 X Rmb 100,000 = Rmb 50 million |

|

In its bag are orders from PetroChina to install similar solar-powered energy systems at 300 petrol stations with another 200 on the way.

In Swing Media's 1H2012 results announcement, the company said that the installations are expected to contribute net profit of about Rmb 30 million (about S$6.0 million) over the next two years.

Profit to be contributed by the 300 solar-powered energy systems already in the bag works out to more than 70% of the Group’s FY2012 net profit of HK$50.4 million (about S$8 million).

"We hope to enter into an agreement for the remaining 200 energy systems soon. We are also confident of winning even more of such contracts. The country’s drive towards sustainable energy and our capability to tap on the growing demand will enable us to significantly improve our earnings and enhance shareholder value," said Mr Hui.

From 10 cents on 11 Jan, Swing Media shares surged 69% to 16.9 cents on 31 Jan 2013 and has remained at 16 cents or more since. Bloomberg data From 10 cents on 11 Jan, Swing Media shares surged 69% to 16.9 cents on 31 Jan 2013 and has remained at 16 cents or more since. Bloomberg data |

Vast market potential

The following trends point to the vast market potential of the solar power market:

1. As at end 2011, China had over 90,000 petrol stations. This number increases with China’s rapid urbanization. More petrol stations are built every time a new highway is added. Mr Hui believes they are one of the first companies to provide solar-powered energy systems for petrol stations.

2. As China faces serious pollution problems and the shortage of energy, its state-owned companies are responding to its national push to adopt environmentally friendly business practices. PetroChina is just one example. Mr Hui hopes to bag orders from SINOPEC next.

3. The use of solar power energy systems can even be extended to streetlights and buildings, etc.

4. With technology advancement, solar-powered energy systems are becoming increasingly cost effective. On the other hand, the cost power from traditional energy sources such as fossil fuels or coal will only increase in the long run.

This trend ensures growing demand for solar-powered energy systems.

"We have a first-mover advantage,” said the CEO.