Excerpts from latest analyst reports

Standard Chartered says China Minzhong trading at distressed levels

Analysts: Pauline Lee & Stephen Hui

We reiterate our Outperform rating on China Minzhong, with a price target of SGD1.56 per share.

We raise our 2013E and 2014EEPS by 2% and 17%, respectively, to reflect stronger growth from both the processed vegetables (driven by capacity expansion) and fresh vegetables segments (driven by strong yield from industrial farming).

We believe the deal is an immediate positive, in that it reinforces the fundamental value of Minzhong’s business, which is trading at distressed levels. Minzhong is trading at 3.7X2014E PER and our price target offers 37% potential upside.

Recent story: CHINA MINZHONG, SERIAL SYSTEM: What analysts now say

OSK-DMG maintains 'buy' on k1 Ventures as it monetises assets

Analyst: Goh Han Peng

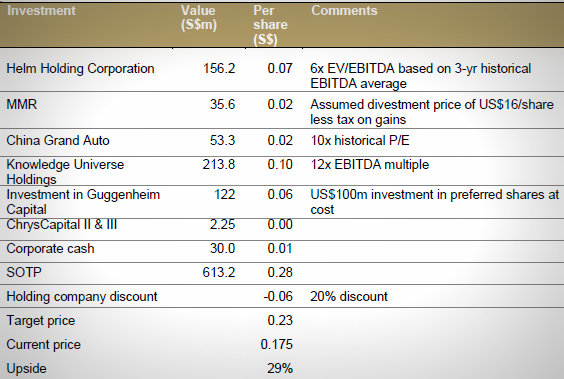

Recent developments suggest several imminent monetization events for k1 Ventures going forward. The declaration of a surprise interim dividend of 1ct/share in 1HFY13 came on the back of a cash distribution of S$27m from KUH on the sale of EmbanetCompass.

Meanwhile, another portfolio investment MMR is currently the subject of a takeover bid by Freeport-McMoRan Copper & Gold.

Next on the divestment slate could be China Grand Auto, which has filed for an IPO on the Shanghai Stock Exchange.

We see the recent run-up in the stock price well-supported given management’s commitment to return excess cash to shareholders on portfolio exits.

A portfolio of high-quality investments underpins our optimism on the stock.

Our TP of S$0.23, based on a 20% holding company discount, offers 29% upside from current levels. We maintain our BUY recommendation.

Recent story: BIOSENSORS, HI-P, k1 VENTURES: What analysts now say...

Comments

Its chart info http://www.sharesinv.com/articles/TC3009104/

ChinaMinzhong share Forum

http://www.sharejunction.com/sharejunction/listMessage.htm?topicId=8335&searchString=&msgbdName=ChinaMinzhong&topicTitle=China Minzhong Food forum