Excerpts from latest analyst reports

OSK-DMG maintains 75-c target for AusGroup

Analyst: Lee Yue Jer

AusGroup announced another contract win yesterday, making it the third contract win in as many weeks since the start of January.

The latest one is a A$20m extension of the Gorgon Project for pipe spools fabrication, following a A$17m sale and hire of scaffolding. We are maintaining our Buy call with a TP of $0.755.

A$280m outstanding order book today. The recent order wins have overtaken the rate of order book consumption, with the outstanding order book rising by A$9m from the A$271m order book we noted in our 7-Jan note.

These bring the total contracts won this month up to at least A$57m (there are possibly small unannounced wins), outpacing by 25% the win rate required for our A$731m revenue forecast this year. We continue to expect a good order win momentum.

ASX listing plans still going ahead. We hosted AusGroup during our Corporate Day last week, and management shared that the ASX listing plans were moving along smoothly.

There is no fixed timetable, though we did sense a certain impetus supporting this move for strategic reasons – once listed on the ASX, we think that a better valuation might be achieved which may then make AusGroup shares more valuable for acquisitions, dovetailing with management’s stated aim of expanding into Queensland.

Recent story: AUSGROUP, DMX TECHNOLOGIES, CHASEN: Latest Happenings

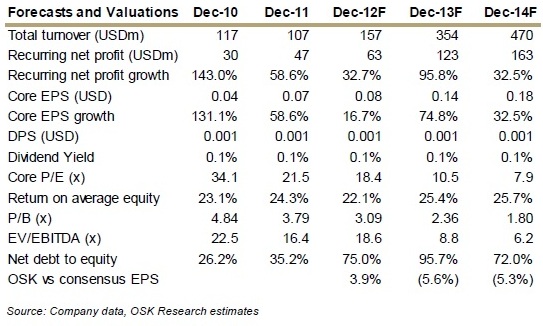

OSK-DMG: "A cash flow perspective of what's in the price of Ezion shares"

Analyst: Jason Saw

We carried out a simple analysis of the cash flow from Ezion’s liftboat assets. Based on existing projects (please see details for other assumptions), we estimate Ezion to be worth S$1.66/share while our blue-sky scenario of ten new liftboats will lift our DCF valuation to S$2.52/share.

The above suggests that the current share price is pricing in extension of existing charters but not more liftboats and service rigs. We see upside catalysts from new charter contracts and EPS upgrades.

Maintain BUY with an unchanged TP of S$2.16/share based on 13x FY13F.