Translated by Andrew Vanburen from a Chinese-language piece by Dongwu Securities

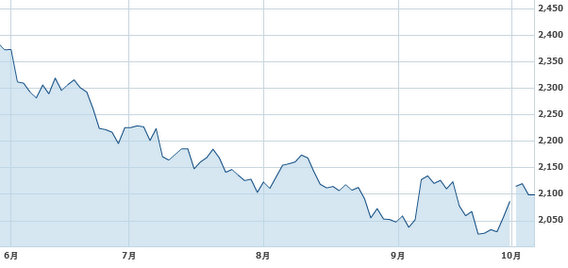

YOU ARE NOT alone if you're wondering why your Chinese shares are struggling mightily this year.

And unfortunately for investors in China’s A-shares in Shanghai and Shenzhen, there isn’t a whole lot of hope for a quick recovery, judging by the way things are shaking out this autumn.

The week began on a downbeat note with property and coal counters pulling down the benchmark Shanghai Composite Index in choppy trade.

Here are eight reasons why shareholders shouldn’t be expecting a bullish end to a decidedly bearish Year of the Dragon:

A major trade fair in the southern Chinese city of Guangzhou has just pulled up its stakes, and the numbers aren’t encouraging.

Orders resulting from the marquis event as well as visitors to the fair were both lower by some 10% on a year-on-year basis.

As Guangdong Province is responsible for around a quarter of China’s total exports, figures coming out of the fair are seen as a key bellwether of the health of the country’s export-driven industries.

Add all this to an upward-trending renminbi currency, and one can only be less than sanguine on China’s export outlook going forward.

This week will also test liquidity in the market as 27 listcos are expected to float 8.45 billion new shares with an aim of raising some 88.8 billion yuan in funds – an exercise which is the biggest of its kind this year.

The lifting of the ban on new shares this week is mainly due to lobbying from blue chips who have been pushing for more fundraising options to kickstart a moribund market.

However, the lukewarm response hardly comes as a surprise amid lackluster investor sentiment.

The third quarter reporting season has come and gone and investors were generally underwhelmed by the July-September and January-September performance of China’s 2,471 reporting A-share enterprises.

Overall, bottom line totals fell 1.3% year-on-year in the third quarter, with 60% of firms reporting higher gearing ratios.

Add to all this the overall declines in revenue for A-shares of late and it’s no wonder market confidence is in such short supply.

The quarterly reports of three blue chips in particular are especially telling.

Agricultural Bank of China Ltd (SHA: 601288), China Everbright Bank Co Ltd (SHA: 601818) and Zoomlion Heavy Industry (SZA: 000157) along with a dozen or so other big plays have all been in the news of late for the wrong reasons.

These three counters in particular have been sold off in droves, a phenomenon which doesn’t bode well for investor sentiment going forward.

Chinese auto parts maker Zhejiang Shibao Co Ltd (SZA: 002703) saw its share price jump over six times during its Shenzhen debut last week.

However, early this week the maker of steering columns and accessories issued a warning over its new shares, saying performance this week is far less robust than last.

The poor reception for new shares of late is a major drag on the overall market.

Baijiu – the potent clear spirit known as “China’s national liquor” – is usually considered downturn-proof.

But this 80-proof drink has seen listed firms engaged in its distillation less than potent of late, pulling down the wide range of A-share enterprises that brew the liquor.

Last week, the two ETFs tracking shares in Shanghai and Shenzhen had a very rough going, hardly a vote of confidence for this relatively new financial product available to investors in China.

Therefore, this ultimate litmus test of market sentiment points to a high likelihood of further falls for the main board.

Finally, there hasn’t been much to cheer about in terms of the Shanghai Composite breaking through the 30- or 60-day moving averages of late.

See also:

Can China Blue Chips Cure Investor Blues?

PARTY TIME: Top Five PRC Earners

POINTING FINGERS: ‘Immature’ Investors At Fault In China?