Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance by Vicky Wang

THERE IS a growing body of evidence that a new CFO can greatly impact the fate of a listed firm.

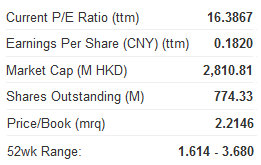

Trauson Holdings Company Ltd (HK: 325) has seen off-the-charts share price rises of late.

Investors have been captivated by the Jiangsu Province-based firm’s recent 315 million yuan order signing for orthopedic products.

The Hong Kong-listed firm’s shares are up 105% since the start of the year, a startling leap that has gained a lot of attention for the manufacturer with just over 1,000 employees.

This all despite the fact that a special caveat to the contract is a stipulation that if the unnamed overseas purchasing department ceases buying surgical and orthopedic equipment as part of the deal, the entire agreement will be made null and void.

For all of last year, Trauson’s orderbook totaled just 384 million yuan, so signing a one-off supply contract for 315 million in one fell swoop is quite an accomplishment for the decade-old medical products maker, which itself is a subsidiary of Luna Group Holdings Ltd.

Such a breakout signing thus guaranteed Trauson at least a respectable year regardless of how many more orders came its way in 2012.

But my job is to look beyond the headlines, bold print and bullet points on press releases.

Therefore, a bit of poking around reveals that Trauson will have more than its share of difficulties meeting the output needs of the mega-contract due to ongoing capacity restraints.

Therefore, investors should not be expecting the company to see a commensurate doubling or even better of its operational revenue this year, unlike its share price which has more than doubled year-to-date.

When share prices shoot up far in excess of anticipated revenue or profit growth, alarm bells should go off in the heads of the more savvy investors among us.

In the summer of 2010, Trauson raised around 760 million hkd with its listing in Hong Kong, with the firm announcing at the time that it planned to use to proceeds to upgrade its manufacturing facilities and provide capital for M&A activities.

But even though only two short years have passed since going public, the company has twice seen newcomers take over the role of CFO at the firm.

Volatility for this position in particular is wont to raise red flags among shareholders, and cast a doubt over the manufacturer’s accounting practices, balance sheet vitality and order reporting authenticity.

The musical chairs-like turnover for the CFO post also explains why the firm’s long term share outlook is a point of widespread disagreement among varying houses, with murkiness characterizing most of the forecasts.

I myself have contacted parties in the know to learn what was prompted the CFO job to be batted about like a hot potato.

The explanations I was given usually revolved around the exiting CFO wanting to be closer to his family in another part of the country, or other such “soft” rationales for seeking a premature resignation.

In April, Trauson announced its new CFO as Ho Ka-man, who would officially assume his new duties on June 29.

A quick Googling of Mr. Ho reveals that he previously served at Kingdee International Software Group Company Ltd (HK: 268) for five years, where he acted as Investor Relations Manager.

Even more interesting for Trauson shareholders is the fact that during Mr. Ho’s half-decade tenure as IR Manager for Kingdee, the cutting edge enterprise management software (ERM) designer enjoyed a steady climb in its share price.

Therefore, don’t let anyone convince you that CFOs or IR Managers are window dressing positions or sinecures in nature.

In fact, as far as share prices and ROIs are concerned, these metrics are often more influenced by the decisions of CFOs and IR Managers than anything a board or CEO might decide to do.

And what could be more welcome a sight to investors than a steadily rising share price?

Increasing Turnover is Key

It appears quite likely that Mr. Ho is committed to using his connections with Kingdee, the funds he courted as its IR Manager, and the broad knowledge of investor relations he has accumulated to bless him with a sure and steady hand on the helm of Trauson’s finances.

His ability to understand the inner financial workings of a major listed enterprise as well as his long-cultivated ties to funds and the IR community will surely pay off as he begins his new tenure with Trauson.

And just to make sure he sticks around longer than his predecessors, Trauson has courted Mr. Ho aboard with a four million share signing bonus.

That being said, if Trauson could do something to boost daily trading turnover of its shares, it would be well on its way to easing doubts of its shareholders and the general investing community.

And with a new CFO having a strong background in investor relations, Trauson will be in a better position to hold existing funds and court new ones aboard.

Mr. Ho's IR upbringing will naturally push him to find ways to boost interest and turnover of the firm's shares -- one of the Holy Grail goals of any IR manager.

Trauson Holdings Company Ltd (HK: 325) manufactures orthopedic products. The Company designs, manufactures and markets products used in the surgical treatment of fractures of the hands, upper extremities, hips, pelvis, lower extremities, ankles and feet, spinal disorders, deformity, fractures and back pain, and orthopedic cables, external fixators and surgical instruments. The company was founded in 2002 and is headquartered in Changzhou City, China.

See also:

UNDEREXPOSED: German Camera Icon Leica Focusing On HK IPO

BAD APPLES: Hong Kong’s Listing Laggards

HK SHARES: Trash Already Tossed To Curb

In Praise Of China’s Retail Investors