Translated by Andrew Vanburen from a Chinese-language piece in Guangzhou Daily

THE BIGGER they are, the harder they fall.

Five years ago, no one was bigger in China than Huang Guangyu, Chairman of China’s top electronics retailer Gome Electrical Appliances (HK: 493) and the country’s richest man at the time, with a net worth of 6.3 bln usd.

However, after stepping down as chairman in 2009, he has been cooling his heels in prison ever since on insider trading and fraud charges.

But the resourceful entrepreneur of humble beginnings who built the Gome empire from scratch is not to be held down for long, as Huang is apparently directing the Hong Kong-listed group’s restructuring campaign from the Spartan comforts of his prison cell.

After the insider trading investigations into the firm and the incarceration of its founder and chairman, Gome understandably underwent a period of managerial chaos, with the rudderless ship desperately seeking a welcoming port of call.

The current shakeups and shuffling at the top levels of the enterprise have the look and feel of direct managerial involvement by the convicted former chairman.

On Monday, Gome announced that it was undergoing a complete revamping of its operational strategy and expansion plans, and that it had already put in place a brand new organizational structure.

With persistent questioning from reporters, it was learned that not only did the extensive management reshuffle at Gome result in the arrival of many new names to the ranks of the company’s leadership, but a batch of new vice president-level positions were created as well.

Current Gome President Wang Junzhou said of the current reforms and restructuring campaign, one of the most striking new developments has been the greater operational and managerial autonomy given to various divisions of the group, including the business development and service areas.

In a note sent to the Guangzhou Daily, Gome confirmed that it had indeed created a number of new high-level, vice-president positions within the group to help manage the different divisions more efficiently and autonomously.

One example of the extent of the changes at the top for Gome is that of former Guangzhou Area General Manager Gao Jiqun, who has now been promoted to the position of South China General Manager. Also, the firm’s former general manager of the Xiamen Area, Han Baoxiang, took over Gao’s newly-vacated position in Guangzhou.

President Wang Junzhou expressed confidence that the broad restructuring of the group will go a great way toward helping Gome meet its ambitious five-year development strategies.

It will also help advance a decentralization of power within the retailing giant’s management core, making each division not only more autonomous and flexible in their daily operations, but also more accountable for their own actions when things go astray.

After the dust settled somewhat from former Chairman Huang’s stepping down in 2009 and his arrest shortly thereafter, Chen Xiao was appointed chairman in January 2009.

The rules of the Hong Kong exchange are quite clear in requiring that the functions of the chairman and president are to remain distinct and roles are in no cases allowed to be performed by the same individual, which prompted Chen to resign as president at the time to take on his new chairmanship role.

So when Chairman Chen stepped down a year ago to “spend more time with his family,” it came as quite the shock.

Imprisoned former Chairman Huang had sought Chen's ouster, but shareholders voted down the proposal.

It appears now that Huang’s wishes have been realized, even from the confines of a prison cell.

Noteworthy is that in the post-Chen era, Huang’s family members – free to move about as private citizens – have been pulling more strings in the company’s operations.

They have been reportedly pushing for the same-store-sales growth and individual shop profitability to be emphasized, rather than focusing on the overall group performance.

This would fit in snugly with the “Huang-esque” preference for a transition to more shop-level, point-of-sale autonomy, essentially making it a friendly “family competition" to see which retail outlet can produce the most impressive sales numbers over a given period.

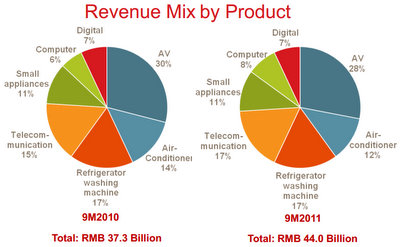

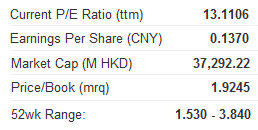

In fact, this emphasis on individual store performance has reaped benefits from the group, with revenue in the first half last year (the latest available audited results) rising nearly 20% year-on-year to 24.9 bln yuan, producing a net profit jump of 30.2% to nearly 1.3 bln yuan.

With this strategy seeming to be working fine, despite a lingering global downturn and slower growth going forward for China, it is little wonder that the former chairman – despite now serving time – is willing to spend some of that free time, along with his family, to help guide the giant ship through the choppy waters of an intensely competitive retail electronics sector.

When the company was asked by the press if former Chairman Huang was behind the recent management shuffling, a company spokesperson responded somewhat indirectly that the personnel changes at the top are ongoing and do not require the approval of the board, therefore indirectly implying that Mr. Huang indeed is pulling some of the strings.

And if he can keep Gome atop the heap, ordinary shareholders are not likely to be too picky about who is calling the shots, as long as the Hong Kong bourse regulator doesn’t object.

And if sales keep charging ahead, this can only be good news for Gome’s nearly 50,000 staff.

See also:

CHINA’S LADY BUFFETT: Liu Ying Making Splash In Hong Kong

Two Different Drivers In Hong Kong’s Ongoing Mini-Bull

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us