Photos and video by Sim Kih.

FACED WITH escalating cost of operations and labor shortage in Chinese coastal cities, manufacturers have been relocating their facilities inland. This has fueled the growth of second- and third-tier cities.

Last week, NextInsight, 3 fund managers and an analyst visited one such city: We flew to the Henan provincial capital of Zhengzhou, a city set to be China's next IT manufacturing hub after world no.1 electronics components player Foxconn set up one of its largest facilities there.

Including immigrants, Zhengzhou has a total population of about 13 million in a land area about 10 times Singapore's.

| NextInsight's video clip of analysts and fund managers' visit to Weiye's Central Park residential condominium project. The project is located next to a park in downtown Xinxiang. We also visited the sales office which showed the estate and apartment architectural models, and viewed completed blocks and sites under construction. |

In its pipeline is a commercial / office project in Zhengzhou as well as residential / commercial projects in the nearby cities of Xinxiang and Kaifeng.

We checked out Weiye’s residential condominium projects in Xinxiang and Kaifeng, which are about an hour from Zhengzhou via rail.

> Xinxiang is Henan’s third largest city with a population of 6 million and home to Weiye Central Park, a huge multi-phase project with a gross floor area of 696,967.6 square meters to be rolled out over 2010 to 2015.

> An ancient city of important cultural significance, Kaifeng is one of China’s top tourist destinations and has a population of 5 million. It is also one of the top 5 cities in Henan's economy.

Weiye's Xiangdi Bay project is located in Kaifeng. The project will be rolled out over 2013 to 2014 and has a gross floor area of 265,635.9 square meters.

Mr Zhang Wei, the founder and executive chairman of Weiye, compared Henan with Hainan where Weiye has property projects.

”Projects in Henan will contribute greater absolute earnings to our company because there is always greater demand for residential homes compared to the holiday homes we built in Hainan.

"In comparison, developing holiday homes give higher margins,” said Mr Zhang when he met us.

In 1H2012, sales recognition of development projects generated Rmb 63.1 million for Weiye, comprising of 87.6% from Henan and 8.4% from Hainan.

Like other Chinese real estate companies, sales recognition is only upon issue of the temporary occupation permit and delivery of the apartment to its homeowner.

Meanwhile, the company collects cash for each sale and books it as current assets over the construction period.

Weiye is in a net cash position.

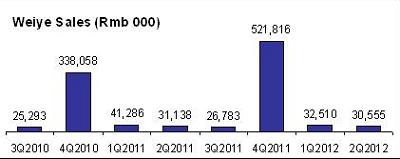

Weiye’s revenues show a seasonal peak during the fourth quarters for a few reasons.

During the first quarter, work halts due to the Chinese New Year holidays. During the second quarter, many of construction laborers in Henan return to their hometowns for harvest and sowing.

Strong speculative demand

We got a sense of the speculative demand in Chinese real estate when we noticed completed apartment blocks that were not lighted up in the evening.

"One could see that these units had been sold as central air-conditioning units had been installed but the homeowner did not need to reside in it," observed Heritage Capital director Nai Boon Hiong.

Last year, Zhengzhou, the capital of Henan province, emerged for the first time as one of China’s top 20 cities for economic output.

During the first 3 quarters of 2012, gross domestic product grew 11.5% to Rmb Rmb 406.5 billion, compared to 7.7% for the whole of China.

Zhengzhou made media headlines after Foxconn decided to set up its iPhone manufacturing facility there.

From US$32.6 billion in 2011, the value of foreign trade in Henan is expected to near double to US$60 billion this year, with Foxconn contributing a whopping two-third share.

In the two years since Foxconn began setting up its manufacturing facility, more than 100 related companies have moved to Zhengzhou.

Most of them are Apple's material suppliers, packing companies, or factories that provide components for Foxconn.

Zhengzhou's other key industries have also grown rapidly, including automotive, machinery and aluminum manufacturing.

At the rate that the province is urbanizing, the Weiye managment believes there is huge growth potential for its property market in the long term.

Related story: WEIYE: Henan's Leading Property Player Rides Hainan Boom