THE BUMPER 30-cent a share special dividend that San Teh will be paying out on Jan 31 is a boon for minority shareholders -- but don't forget that the major shareholders are by far the greatest beneficiaries.

Just take the case of Kao Shin Ping, the Executive Chairman, Director and founder of the company.

And consider also his wife, Mrs Kao, who is the Executive Director responsible for the finance and administration of the Group.

Here is a breakdown of their big hongbao which will be paid out following the divestment of San Teh's cement business to China Resources (a large Chinese state owned enterprise).

According to San Teh's 2010 annual report, as at 31 Mar 2011 Mr Kao owns 63.96 million shares (18.6% stake in San Teh) in his own name -- that means S$19.2 million in special dividend.

He owns a 60% stake in an investment holding company, San Teh Xing Investment Pte Ltd, which holds 60.4 million San Teh shares.

So, Mr Kao's interest works out to be 36.3 million San Teh shares and a special dividend of S$10.9 million.

That adds up to S$30.1 million. Cash.

Then there is his wife, who owns 29.4 million shares directly - which will reap S$8.8 million.

Her 10% interest in San Teh Xing Investment equates to $3.2 million of special dividend.

In total, the couple will collect S$42.1 million!

And that's not counting their joint interest in 19.2 million San Teh shares held by Hong Leong Finance Nominees Pte Ltd.

With all that cash pouring in, will the couple deploy some of it to buy the company stock, which currently trades at around 27 cents (ex-dividend)?

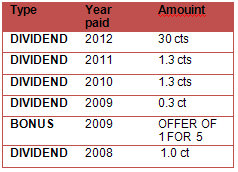

The stock is seen by value investors to be a bargain based on the fact that the company has 40 cents in net cash a share -- this, after paying the special dividend and after repaying all its bank borrowings using the proceeds from the divestment of the cement business.

The 40-cent net cash is conservatively derived -- it does not include the S$129 million cash on San Teh's balance sheet as at end-Sept 2011.

Given the cash hoard, some investors have expressed the hope that the company would pay out a second special dividend.

That cannot be ruled out but the company has said that it would retain the balance from the cement business divestment as working capital --- for the Group’s hotel and PVC pipes business operations -- and for undertaking new investment opportunities that may arise.

Its hotel and pipes businesses, by the way, lost money -- about S$7 million -- in 9M2011, which is a smaller loss (if it's any consolation) than the S$18.5 million in 9M2010.

Recent story: SAN TEH is a 'Net Net' stock with 30-c special dividend coming

Comments