BOCOM: HK CONSUMER SECTOR ‘Outperform’

Bocom International said it is assigning an ‘Outperform’ recommendation to Hong Kong’s consumer sector, but with luxury-based plays seen taking a harder hit going forward due to customers tightening their pursestrings amid economic uncertainty.

Hong Kong retail sales grew 23.1% year-on-year in October.

The growth fared less well compared with the 24.0% in September but was better than the market consensus of 20.5%.

“Looking ahead, with rising macro headwinds and higher base effect (as 4Q growth last year started to record a more noticeable expansion), we expect the slowing growth trend to continue.

"Among all, we believe the luxury end segment to be more vulnerable to the cut of discretionary spending and its knock-on margin impact due to the rising risk of operating de-leveraging should not be overlooked,” Bocom said.

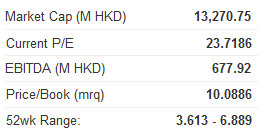

On the contrary, the brokerage said it sees Sa Sa (HK: 178; ‘Buy’) and Lifestyle (HK: 1212; ‘Buy’) as the key defensive counters in the Hong Kong consumer universe in light of their growth resilience underpinned by the sustainable stream of strong spending by mainland tourists.

Jewelry and watches continued to show the strongest growth, followed by clothing and footwear.

Looking at the key categories, sales of jewelry and watches increased the most (by 47.5% in Oct versus 50.6% in Sept), followed by clothing and footwear (26.3% versus 32.9%), consumer durable goods (20.2% versus 19.7%) and department stores (17.4% versus 21.6%).

“That being said, except for consumer durable goods, all these key categories showed an easing growth trend, a key point to note,” Bocom said.

Overall, for the first ten months of 2011, Hong Kong retail sales growth was 25.2% (vs. 25.4% in 1-3Q11 and 24.4% in 1H11).

See also:

Supply-Side Pride As MING FAI Named HK ‘Outstanding Enterprise’

BAGGING ASIA: COACH HK Listing Eyes China Luxury Market

BOCOM: CHINA PROP SECTOR ‘Market Perform’

Bocom International said rebounds in Mainland China’s property sector tend to be short-term.

The recent 50 basis point cut in the Required Reserve Ratio (RRR) triggered a significant sector rebound.

“More loan opportunities from banks seem to be favorable to high gearing developers and end users in the residential property segment. However, we believe the high gearing haracteristics would remain unpopular by the market amid a strict attitude from the central government towards the sector,” Bocom said.

The brokerage added that anxiety over property prices in the future remains the most decisive factor for end users in their decision making.

“Therefore, we think the sector rebound would likely be short term. Greentown (HK: 3900; ‘Sell’), R&F Properties (HK: 2777; ‘Sell’) and Poly HK (HK: 119; NR) have achieved short-term rebounds due to their high gearing nature, but we maintain ‘Sell’ ratings on Greentown and R&F as their current valuations are not justified by fundamentals.”

It was also recently reported that Greentown may offer 20% discounts on some projects before Chinese New Year to help spur transaction volume.

A 20% price cut is an essential strategy if Greentown China wants to achieve sales target of several dozens units before year end, Bocom cited an industry expert as saying.

“On the other hand, we suggest accumulating Shimao (HK: 813; ‘Buy’) and Yuexiu (HK: 123; ‘Buy’) since they have been behind in terms of valuation.”

See also:

The Value In Suntec REIT, The Upside From $400m Of Asset Enhancement Initiatives

Shareholders Blast NEW WORLD DEVELOPMENT Share Offer