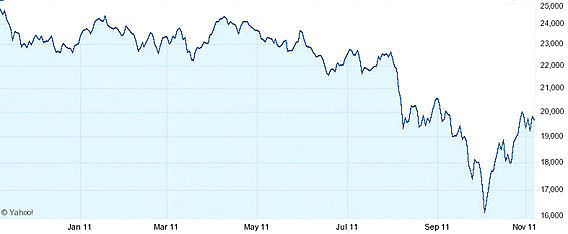

HONG KONG’S benchmark Hang Seng Index is finally showing signs of life, with some counters making serious headway on the valuation front.

But that in no way means that there are still not bargains galore, Chinese-language portal Sinafinance cited regular contributor Mr. Zhang Chunzhi as saying.

It also doesn't mean that investors should take the current bear market for a buffet table and take a sampling of everthing to enrich their dining experience, for not all sectors are likely to recover equally.

However, the fact of the matter is that the recent gutting of valuations across a wide swath of sectors means that undervalued gems are there for the trained eye to espy.

The drawn-out downturn also means that price recoveries could be the norm rather than the exception – sooner than later.

Hong Kong-listed PRC-based sportswear firms have been particularly pummeled of late.

Li Ning Co Ltd (HK: 2331) China Dongxiang (Group) Co Ltd (HK: 3818) -- owner of the Kappa brand in the PRC -- and ANTA Sports Products Ltd (HK: 2020) have begun to put on their running shoes and slowly jog back into positive territory.

A litmus test of business sentiment in any advanced economy -- such as China's -- is the fate of software serving B2B, B2C, and in-house commercial clients -- especially Enterprise Resource Planning (ERP) software firms.

Therefore, if one firm's optimism is any indication, then things may soon be looking up across the board.

Chen Dengkun, CFO and VP of enterprise management software and e-Business application solutions firm Kingdee International Software Group Co Ltd (HK: 268), said: “Our clients are mainly SMEs, and they are nearly all suffering the downside effects of falling exports and monetary tightening, and growth for them has generally slowed.

“However, we believe that there are definitive opportunities amid the current downturn, especially in areas such as cloud computing. We won a contract in this new and fast-growing IT area from a fund firm with AUM of 25 mln yuan.”

The CFO went on to say that he was “confident” regarding the strategic enterprise management software market in Mainland China over the next ten years.

“It will be a ‘golden decade’ for the sector, and we will use our market-leading position to promote industry consolidation,” Mr. Chen added.

However, not all counters are expected to make a near-term bounceback.

Air China Ltd (HK: 753) is having some trouble readying for a takeoff.

The Mainland’s flagship carrier saw pre-tax profit from core operations in the first three quarters of some 4.42 bln yuan, down 14% year-on-year.

Meanwhile, its gross margin in the January-September period stood at 25.52%, down around 3.33 percentage points from year-earlier numbers.

Air China is also seeing lower-than-industry average transport capacity performance.

This does give pause to those predicting a sustained and imminent bull run, as passenger and air cargo numbers are often a reliable bellwether of economic trends to come.

See also: FOCUS MEDIA: Capturing Captive Audiences In Singapore, Hong Kong