IN ONE of the most volatile trading weeks in recent memory, Hong Kong’s benchmark Hang Seng Index shed a shocking 6.3% this week, but managed to eke out a 0.13% uptick today to finish at 19,620.01.

This week’s hemorrhaging along with last week’s selloffs marked the worst two-week performance by the Hang Seng since November 2009. Analysts say investors will be taking cues from the slew of large-cap interim earnings due out soon.

The chaotic roller coaster ride that shares in New York and Europe have taken investors on these past two weeks was chiefly to blame for the Hang Seng’s major selloffs of late, with one of the major blows coming from S&P’s recent downgrade of the US’ sovereign credit rating.

In a Chinese language piece in Sinafinance, a market watcher with KAB International was cited as saying: “The next level of support will be at around 19,600, with resistance likely at 20,100. After the past couple weeks of bloodletting, bargain hunters will be out in force next week and an upward correction is highly likely.”

Another analyst at Victory Securities said: “There is no shortage of political and financial tumult in major markets around the world right now, which is causing both irrational panic selling and then reflexive panic buying.

“Not helping matters is the sluggish US recovery and possible new banking problems in the EU. Therefore, investors should be extremely cautious in the near term until things settle down somewhat. This is no ordinary shakeup.”

Sinafinance also cited a market watcher from Friedmann Pacific Securities as saying: “There is definitely pronounced overselling taking place at present, with actions in Hong Kong closely mimicking behavior from the previous day’s trading in New York. Therefore, a major upward correction is overdue after this three-week downturn.

“However, investors should be very wary of any new stimulus action from Washington, with the possibility of a QE3 in the near term not out of the question.”

Due to the sharp fluctuation on the Hong Kong capital market over the past several trading sessions, there was no overriding theme to today’s big winners and losers.

Most of the major gainers today benefited from either sharp selloffs earlier in the week, or just-released earnings that surprised on the upside.

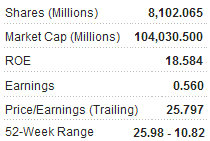

One such was trading firm Li & Fung Ltd (HK: 494) which shot up 7.0% today to close at 12.84 hkd thanks to better than expected interim earnings.

Financial sector giant China Life Insurance Co Ltd (HK: 2628) ended the day up 3.50% at 22.2 hkd after its recommendation was boosted to “outperform” from “neutral” by Credit Suisse, with the investment bank saying the insurer had only 15% of its assets in equities as well as having close to historically low valuations.

Personal hygiene product giant Hengan International Group Co Ltd (HK: 1044) also ended with a decidedly bullish flair, adding 4.26% to close today at 67.3 hkd.

Analysts said that Hong Kong investors will need to continue to keep one eye on the financial and budgetary woes in North America and Europe as well as also monitoring the performance of major H-shares listed in Hong Kong whose first half earnings statements are due out soon.

Some of these include Anhui Conch Cement (Monday), China Coal Energy and China Minsheng Banking (Tuesday), and Ping An Insurance (Wednesday).

See also:

DIAMONDS IN THE ROUGH: Finance Chief Hawks Hong Kong

FOCUS MEDIA: Gen2 Fund Boosts Stake In HK/Singapore Ad Firm