Excerpts from analyst reports...

GOUCO: BUY on GUANGDONG INVESTMENT

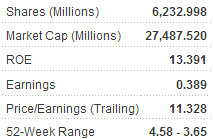

Guoco Capital said it is maintaining its BUY call on Guangdong Investment (HK: 270) with a six-month target price of 4.90 hkd.

The company operates water supply, power and electricity, and infrastructure businesses. It also invests in and develops real estate properties, operates department stores, and provides financial services.

“GDI outperformed the HSI by 23% over the past three months. We believe this is due to its defensive nature that attracts investors amid an oscillating market. GDI’s water distribution and property investment contributed 69% of revenue and 95% of EBIT over the past five years on average.

“Given the exclusive right of water distribution and high occupancy rates of existing investment properties (94% for HK segment and 99% for PRC in 2010), a substantial decline of cash flow from these businesses is unlikely.”

Guoco added that stable cashflow enables the company to maintain a steady dividend payout.

“Analysts generally expect DPS of 0.15 hkd in 2011, translating into a dividend yield of 3.3%. The dividend forecast is fair in our view as the company’s free cash flow exceeds 0.41 per share over the past five years and will reach 0.56 in 2011 according to our estimate.”

2H water tariff hike major share price catalyst

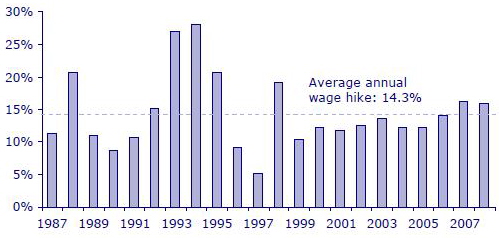

The three-year water tariff agreement between Guangdong and Hong Kong is subject to renewal this year and the decision will be made in 4Q11, Guoco said.

“The contract is key to GDI’s earnings in the next three years as water distribution to Hong Kong accounted for one-half of the company’s revenue in 2010. Inflation, RMB/HKD exchange rate and operating costs are the major issues of tariff negotiation.

“Management expects to see single-digit growth in the tariff while analysts generally expect a tariff hike of 6% per annum from 2012 to 2014, similar to the 6% CAGR of the water tariff from 2006 to 2011.”

See also: FOUR STRATEGIES For Nabbing Bargain HK Shares

BOCOM: PRC COAL firms still OUTPERFORM

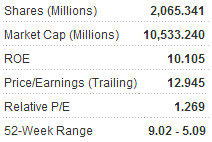

Bocom International said it is maintaining its OUTPERFORM rating on Mainland China’s Hong Kong-listed coal firms.

Thermal coal prices retreated slightly The price of thermal coal at Qinhuangdao Port dropped to RMB890/ton, up 13.4% YoY and down 1.7% MoM.

The spot price of Australia BJ steam coal rose 26.6% YoY and dropped 0.5% MoM to US$120.35/ton. In 1H11, volume of domestic coal exports and imports decreased by 13.7% YoY and 11.8% YoY respectively.

Inventories at Qinhuangdao Port continued to improve and coal reserves and supply of major power plants remained sufficient, Bocom said.

“Output of the 4 major downstream industries maintained growth on a yearly basis and buoyant demand supported high coal prices.

“We are optimistic over the coal price movement and profit growth of listed coal enterprises ahead. We maintain an OUTPERFORM rating for the sector and recommend BUY for Yanzhou Coal (HK: 1171), Hidili Industry (HK: 1393) and Winsway Coking Coal (HK: 1733).”

See also: FOCUS MEDIA: Singapore, Hong Kong Ad Firm's HK Placement 20x PE