Star Power: Fashionable first-timers to the Hong Kong mainboard like Prada are helping liven up the bourse. Photo: Prada

However, when we realize that the average loss per investor was 240,000 yuan, it really brings the downturn home, says a Chinese-language piece in Sinafinance recently.

How did it happen and will things turn around in the second half?

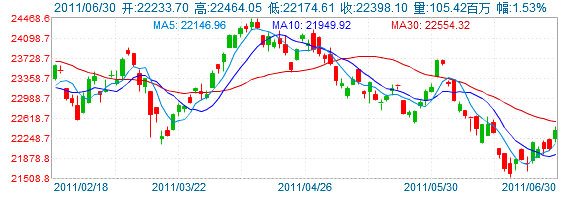

The benchmark index of the Hong Kong bourse, the Hang Seng, jumped 1.53% on the last trading day of the first half, and another 1.66% Monday.

This recent bullishness aside does not disguise the fact that serious bloodletting occurred in the first six months.

Greek Tragedy?

Birthplace of Democracy... and Debt? Greece's budgetary woes have been a drag on Hong Kong shares. Photo: visitgreece.gr

Sinafinance explained that the Hellenic Republic was commonly seen as a metaphor for the possibility of a domino-effect default disaster hanging Damocles-like over not only the fate of several European states, but the beginning of the end of the whole concept of the EU.

Luckily, cooler heads prevailed and the Athenian government recently passed an rather Draconian austerity plan which sows the seeds of a more rational budgetary policy going forward.

The move, which sparked a wave of anticipated street protests in Greece, also opened a window of optimism for investors – given that the EU is now the chief trading partner of Mainland China – which helped give an 11th hour first-half boost to investors in Hong Kong.

Loss Leader: The Hang Seng's descent this past half hit shareholders' wallets hard

But among bourses in the region, the Hong Kong capital market was one of the poorest performers in the January-June period.

Market capitalizations of Hong Kong-listed firms shed some 500 bln yuan with only the debut of global giants like top-end fashion name Prada and Swiss commodities trader Glencore -- both of which recently fell a bit flat in their Hong Kong listings – helping add star power and capitalization to the bourse (if not crimping liquidity in the process).

Winded: Beijing Jingneng Clean Energy, seeking some 4.9 bln hkd in proceeds, retreated from its Hong Kong listing plan last month amid market doldrums. Photo: Beijing Jingneng

Beijing Jingneng Clean Energy, which was seeking some 4.9 bln hkd in proceeds, as well as CT Environmental both opted out, with the latter abandoning its plan to raise 90 mln, and the two firms blamed weak sentiment for their decisions.

However, not all is lost for Asia’s “financial center,” with eight other aspirants planning near-term debuts in Hong Kong.

Part of the apparent sentiment schizophrenia stems from the recent resolution of the nagging Greek debt crisis, and the general belief that the months-long spate of credit tightening measures from Beijing will finally begin tapering off.

This has led a good number of market watchers to predict that 28,000 may be a reality – sooner rather than later – for the benchmark Hang Seng Index (currently at 22,770).

Like them, investors will be watching the market... and waiting.

See also:

MAN WAH: Sofamaker’s FY11 Sales Surge 30% To 3.8 Bln HKD, US Mkt Afire

HK WRAP: Index Down 2.8% In 1H, Analysts See 2H Climb