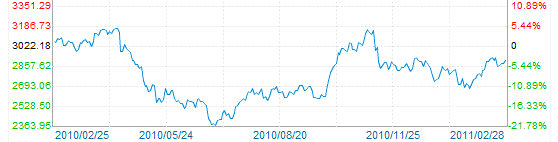

CHINA’S SHANGHAI COMPOSITE, the benchmark index tracking both A and B shares, closed up 0.92% on the last trading day of the month, finishing at 2,905.05.

February was kind to the markets, with the post-Chinese New Year Holiday trading leaving the Index 4.1% higher today compared with January 31, and with a major economic meeting by Communist Party officials on Thursday, analysts see this as a key week for the bourse.

A Chinese language piece in SinaFinance said it expected the market to closely watch any pro-growth announcements out of Beijing leading up to and on Thursday itself – the day the country’s legislature gathers each year to formulate economic policy going forward.

Taking a cue from upbeat expectations of new industrial measures friendly to the markets this week, construction firms led the charge in trading today.

Heavyweights in the sector lifted the Construction/Developer sub-index 4.63% today, making it the day’s top performer.

Suzhou New District Hi-Tech Industrial Co Ltd (SHA: 600736) rose by its daily 10% upside limit, as did Shanghai 3F New Materials Company Ltd (SHA

Sany Heavy Industry (SHA:600031), China’s top heavy equipment manufacturer, shot up 8.5% to 25.20 yuan, Shantui Construction Machinery (SZA: 000680) rose 6.1% to 21.97 and Changsha Zoomlion Heavy Industry Science & Technology Development (SZA: 000157) added 4.7% to finish the day at 15.20.

Real estate developers, construction materials and earthmoving machinery firms like Sany Heavy and Zoomlion were also responding to the positive news coming out of Beijing yesterday.

President Hu Jintao announced that the government aims to build some 36 million residential units – all to be earmarked as public housing -- over the next half decade to help ease a housing crunch and also help contain the possibility of public unease over rising property prices and the ever-present threat of out-of-control inflation.

However, despite recent alarming rises in the CPI, the chief barometer of inflation in the country, analysts also said they expect no near-term hikes in key interest rates by the central bank as the Thursday legislative meeting was focused on economic growth as a first priority – not additional credit growth controls.

This also provided another shot of confidence to general trading sentiment today.

Brokerages also rallied today on anticipation of pro-growth pronouncements from the capital on Thursday.

Changjiang Securities (SZA: 000783) added 5.6% to finish the day at 13.55 yuan, Hong Yuan Securities (SZA: 000562) rose 3.3% to 18.80 and Citic Securities (SHA:

TCL Corporation (SZA: 000100), one of China’s top television set makers and a growing presence in home appliances, also rose its daily 10% upside limit after announcing its 2010 sales revenue grew 17.1% to 51.87 bln yuan, mainly on exports.

Home appliances revenue shot up 44.17% to 4.5 bln yuan, the bulk of which was attributed to air-conditioner sales.

Looking forward, analysts expect Thursday’s legislative gathering to reemphasize growth – but stable growth – as the primary objective, with strategic industries including new energy technologies likely to receive some of the most positive attention from officials.

See also:

CHINA SHARES Up 1.12% Despite New Reserve Requirement Hike

SUNDART, ZOOMLION, MICROPORT: What Analysts Now Say...