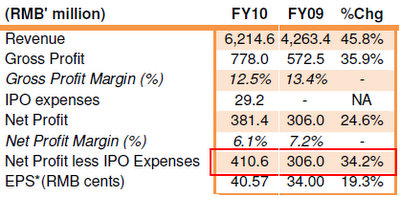

DBS Vickers analyst Lee Eun Young says that XinRen Aluminum’s 2010 net profit of RMB381.4 million exceeded her expectations by 2.9%.

She now has a target price of 70 cents for the stock, which represents a 61% upside potential from the 43.5 cents that it closed at recently.

Listed on the Singapore Exchange in Oct last year at 55 cents, XinRen is the only producer and fabricator of aluminum on the bourse, although there are several such companies on the Hong Kong bourse including United Co. Rusal, the world’s biggest aluminum producer.

XinRen attributed its 24.6% year on year rise in net profit (34.2% if IPO expenses were excluded) to strong aluminum prices and higher-than-expected margins and sales volume for its fabrication products.

Aluminum spot prices have gone up almost in a straight line (from below RMB14,500 a tonne in June 2010 to above RMB16,500 in February this year) on the back of a 10% year-on-year rise in the consumption of the metal in China.

Spurred by a rise in the production of consumer products made of aluminum, the price trend is expected to continue as consumption is expected to outpace production up to 2013, according to China industry research.

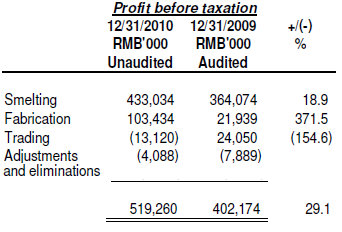

The other factor boosting XinRen's profitability was its expanded fabrication capacity – it completed a new aluminum plate production line in 4Q2010, boosting its production capacity by 70% and giving it the flexibility to export aluminum plates for better profit margins.

2011 – doubling fabrication capacity

By 3Q, XinRen would have doubled its aluminum fabrication capacity in its Jianyin plant to 100,000 tonnes, churning out aluminum sheets, foils and coils.

The significance is not only in the doubling of capacity – this fabrication business earns gross profit margins of about 20%, compared to 12-13% for smelting.

Taking a conservative but still optimistic outlook, XinRen has put out word that it expects its profitability this year would be “comparable, if not higher, than FY2010.”

On the other hand, a few factors could pressure the margins and the bottomline, including a rise in electricity tariffs. XinRen estimates that a 1% rise in tariffs would shave 2.2% off its net profit.

Its shares recently traded at 43.5 cents which, on an EPS of 40.57 RMB cents, translates into a PE of just 5.5 - a valuation no doubt owing in part to the market correction triggered by the Middle-East political unrest and high oil prices.

These circumstances have claimed a victim in China Hongqiao Group, the mainland's second-largest privately owned aluminum producer. In late February, the company called off its HK$17.2 billion IPO in Hong Kong "in light of the deteriorating market conditions since the publication of our prospectus on 27 January."

Recent stories:

Insider Buys: QINGMEI, SINOPIPE, HLN, XINREN ALUMINUM

XINREN ALUMINUM: On-the-ground insights into its fast-expanding fabrication plant

UNITED CO RUSAL: World leading aluminum producer rose from the ashes, now rides on Russian boom