THE EDGE Singapore weekly has come up with its choice stocks for 2011, after its 2010 portfolio gained 22.5% to outpace the ST Index which rose 17.9%, including reinvested dividends. (The performance was measured from 25 Jan 2010 to 27 Jan 2011).

Below are bite-sized comments from The Edge on its 2011 picks. For its full-blown 8-page report, go buy a copy of the weekly from the newsstands for $3.80.

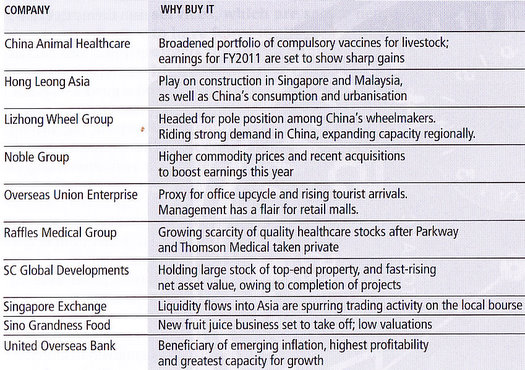

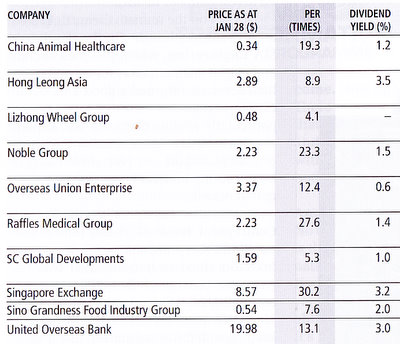

* China Animal Healthcare: It manufactures three out of the four compulsory vaccines required by China’s Ministry of Agriculture – those for swine fever, blue-ear pig disease and foot-and-mouth disease.

Kim Eng Research forecasts a 37% surge in turnover and a more than 100% jump in earnings for CAH. Its price target is 48 cents, valuing it at 15X earnings.

* Hong Leong Asia: This is one of the two largest suppliers of ready-mixed concrete in Singapore. It also has a 72.8% stake in a Malaysia-listed cement producer. However, The Edge's stock pick runs contrary to ‘sell’ calls by CIMB and DBS Vickers.

* Lizhong Wheel: It is one of the three largest wheelmakers in China and is expanding its production capacity to become the largest player soon. Last year, it raised capacity by 30% and still kept utilization at 90%. This year, the number of wheels it sells could rise 25%.

* Overseas Union Enterprise: It is riding an uptrend in office rents and surging tourist arrivals.

* Raffles Medical Group: After Parkway Holdings and Thomson Medical Centre were acquired and delisted last year and early this year, respectively, the Singapore market is short on quality healthcare plays. Raffles could be the next takeover target.

* SC Global: The company has been buying back its own shares in the market despite its net debt to equity ratio being more than two times and it has $816 million of debt to refinance within the next 12 months.

* Singapore Exchange: It is benefitting from soaring trading volumes as Asia attracts a gush of money from the US.

* Sino Grandness Food Industry: The company has morphed from being a packaging agent for fruits and vegetables for sale in Europe to being a producer of fruit juices for the China market – and this is boosting its revenue and earnings sharply.

* United Overseas Bank: It is among the local banks that could be beneficiaries of inflation and rising interest rates in 2011.