SOME MONTHS back, intrigued by a NextInsight reader's postings in our forum, I asked him out for coffee. I only knew his nick (Observer2) from his forum postings and I contacted him via his email address that he had registered with us.

From his postings, I judged that he was knowledgeable about analysing businesses.

That impression was confirmed when we finally met – Observer2 turned out to be a seasoned investor who has lived through the pain and exhilaration of the stock market of the 1990s and 2000s, and learnt to navigate better the market.

He has had many a successful investment in recent years which bagged big profits, and he has put in lots of legwork (in addition to paper work) by attending various investor meetings that companies organized. Not surprisingly, I subsequently ran into him at some of these events.

Now, 2 stock picks which he wrote about in our forum thread (Readers’ Top Picks) are right on the money, so far.

The stocks – Fujian Zhenyun Plastics and QingMei Group – have chalked up double-digit gains in the past month or so.

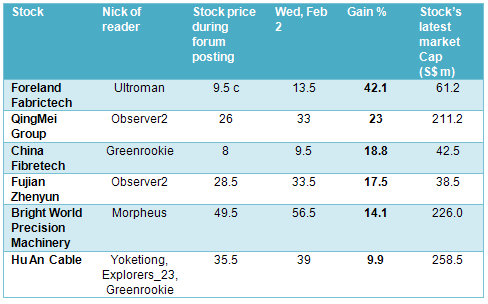

These 2 are among 6 stock picks of NextInsight readers that have gained between 9.9% and as much as 42% within a month or so.

They were highlighted in the forum thread (Readers’ Top Picks) as part of our fun competition to encourage readers to share their best stock ideas and see whose picks make the most gains in percentage terms by the end of the first quarter.

There are 3 prizes of i-Balls sponsored by Trek 2000. We are still open to stock nominations - check out our forum for the Part 3 thread of Readers' Top Picks. (And read the original story/invitation: Share your TOP PICKS - and win cool prizes from Trek 2000!)

The top stock performers to date as shown in the table are all S-chips – which is not entirely surprising considering that China’s economic growth is powering ahead and contributing to the rebound in the earnings of many S-chips.

In this brief update, we give a snapshot of the performers (and will provide a full and final report after March 31 by which time the names on the list could have changed substantially):

* FORELAND FABRICTECH (up 42%): This and another performer, China Fibretech (up 18.8%), operate in the textile industry.

NRA Capital has forecasted that Foreland’s net profit would more than double from RMB31.1 m last year to RMB64.4 million this year.

China Fibretech’s fortune also is looking up. It announced on 17 January that its 4Q10 revenue and profit would be materially higher than 3Q10’s.

CIMB said that China Fibretech offers a big margin of safety as its net cash per share is S$0.147, and book value per share is S$0.20 while the recent stock price was S$.0.095.

Recent stories:

HU AN CABLE, ERATAT LIFESTYLE, FORELAND FABRITECH: What analysts say now....

HONGWEI, CHINA FIBRETECH, LONGCHEER, TEE: What analysts now say....

* QINGMEI GROUP: This went IPO at 31 cents in March 2010, and is in the business of manufacturing high-end soles for sports shoes.

Its last closing price was 33 cents, up 23% from the 26-cent level when reader Observer2 highlighted it.

The industry looks to be a competitive one – just like the textile players – but Observer2 reckons QingMei stock can achieve 100% gain to 52 cents because of the massive capacity expansion it would enjoy from Jan this year.

Recent story: Insider Buys: QINGMEI, SINOPIPE, HLN, XINREN ALUMINUM

* FUJIAN ZHENYUN: This is a special situation kind of stock as it was hammered down when its external auditors was unable to pass its annual accounts because of dissatisfaction over certain business transaction records.

Subsequently, a Special Auditor was tasked to look into various aspects of the business and its records and has issued a report, which doesn’t seem too damning. The stock has recovered somewhat but is way below 45 cent-level it was at 12 months ago.

'Observer2' has pointed out that Fujian Zhenyun's Net Asset Value was 95 Singapore cents as at end-Sept 2010, which is sharply higher than its trading price of 33.5 cents recently.

2009 NextInsight interview: FUJIAN ZHENYUN to benefit from China's stimulus package

* BRIGHT WORLD PRECISION MACHINERY: This stock was one of the best performers of 2010 but reader Morpheus reckons there is some more upside.

Indeed, the stock has gone up 14% since he recommended it about a month ago as its prospects became clearer and stronger.

Bright World has just secured contracts worth 48.0 mln yuan, an all time record for sales orders won in a single day, for its metal stamping equipment.

Recent story: SITE VISIT: BRIGHT WORLD Stamping Major Name For Itself In PRC

* HU AN CABLE: This stock has done well since it was recommended by no less than 3 readers, chalking up a 9.9% gain.

However, it has yet to recover above its IPO price of 41 cents, and its stock price movement has not been on a consistent uptrend.

Hu An operates in China's cable industry which appears to have a strong future but Singapore investors have yet to appreciate that, except for SEAVI Advent which bought a stake in the company.

SEAVI's fund manager has declared that it was one of only 3 stocks it had bought last year out of 300 that it had evaluated.

Recent stories:

HU AN CABLE: Why it's one of only 3 stocks SEAVI invested in this year