IN A REPORT this morning that is bound to be widely quoted, the Kim Eng Research team headed by Stephanie Wong has recommended 7 small cap stocks for 2011. They include 2 stocks to buy for their yield - Starhill Global REIT (current price 63.5 cents) and Boustead Singapore ($1.11) – and five for growth and value, as follows:

Our two value stocks have one thing in common – both derive their value from the assets they have on the ground. Energy play RH Petrogas (RHP) and land play Gallant Venture are trading at huge discounts of 30‐70% to our conservative valuations. If you can afford to wait for the huge value still buried deep underground to be uncovered, we reckon you will reap outsized returns. Gallant’s much sought‐after landbank in Bintan, for example, is held at cost of just $3 psm but is currently being sold at $110 psm on average!

RH Petrogas (87.5 cents, target $1.35) – energy play with vital assets above and below ground

RHP is an energy play that began its foray with the acquisition of an oilfield concession in Northeast China. It subsequently acquired, from Temasek Holdings, a Singapore company called Orchard Energy that has an oilfield concession in West Belida, Indonesia. RHP then wasted no time in buying a third oilfield concession in West Papua, Indonesia. As it used to be an electronics contract manufacturer with no prior track record in oil extraction, the ace up its sleeve now is the inheritance of Orchard Energy’s capable management team, led by 30‐year industry veteran Dr Tony Tan.

It is also backed by the Rimbunan Hijau (RH) Group, one of the largest and strongest conglomerates in Malaysia. Catalysts include the likelihood of more oilfield asset injections by the RH Group. While we believe RHP will issue more new equity in order to finance its development plans, any new issue is likely to be backed by Temasek, which has an option to subscribe to the new equity.

Gallant Venture (42 cents, target 75 cents) – entering a virtuous cycle of growth

Back in 2007, Gallant traded as high as $1.56, or 3x its book value, as the market viewed with wild enthusiasm the development potential of its valuable landbank in Lagoi Bay, Bintan. However, the stock was severely hit during the financial crisis, tumbling to as low as six cents, as buyers held back and development plans were put on hold for lack of financing.

It was a big blow but it did not deter Gallant from continuing to invest in Lagoi Bay by laying down the infrastructures and building the landscape to increase the attractiveness of its land parcels for future sales. By 2010, its investments bore fruit. Land sales resumed, more land deals were secured, and the construction of Lagoi Beach Village, a central component of its Lagoi Bay township, started.

In addition, Landmarks Berhad will resume the development of its Water Resort City soon. However, Gallant’s share price is still trading below the 2007 peak. Currently trading at 19% discount to its book value, the stock is grossly undervalued because a large chunk of the company’s assets is its landbank in Bintan, which is held at a cost and only a fraction of the prevailing market price.

To grow is to be glorious

The growth companies within our selection are in businesses as different as night and day. China Animal Healthcare provides vaccination drugs for domestic meat animals in China, Super Group is a market leader in convenience foods such as 3‐in‐1 coffee mixes in the region with its biggest market in Thailand, and CWT has ambitions to build a logistics empire as global as any other. However, all three have one thing in common – the potential for high earnings growth but are not yet priced as such. This therefore opens the way for ahead‐of‐the‐curve investors to make supernormal returns. In addition, at least one stock – Super Group – might attract new investors that could spark a further re‐rating.

China Animal Healthcare (33.5 cents, target 48 cents) – the healing touch

Rising meat consumption, along with higher animal drug penetration and the strong likelihood of industry consolidation, is expected to keep China’s animal drug sector boiling over. In our view, this sector holds tremendous promise for many years to come and CAH is well‐positioned to ride this rising trend.

The company has set its sights on capturing a bigger market share through selling a wider range of products to retailers and expanding its current pool of sales and technical personnel. It will also invest more in research and development to stay ahead of competition. The improving prospects notwithstanding, we believe its share price has yet to catch up with its pre‐crisis valuations.

CWT ($1.18, target $1.70) – expanding logistics empire

Back in 2007 when its share price was at the peak, CWT was aggressively expanding its warehousing capacity and gearing up its balance sheet to match. Fast forward to today, substantial sale‐leaseback gains from these buildings sit snugly in the coffers and the balance sheet is healthier than ever. This war chest will help fund CWT’s fast‐expanding global logistics empire.

The financial crisis has also thrown open opportunities to acquire businesses and talent it has been tracking for years, especially in Europe and Africa. Interestingly, the Loi family, who in addition to holding a substantial stake in CWT and also manages the company, has been aggressively buying shares from the open market, even at a post‐crisis high. We regard this move as a clear sign of the family’s quiet confidence in the business prospects.

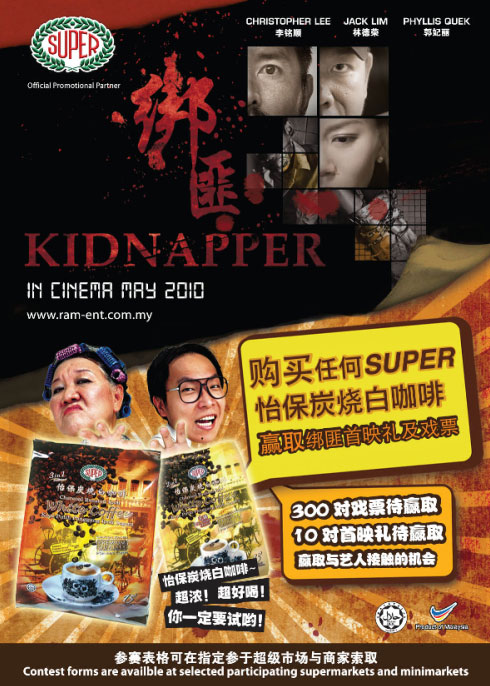

Super Group ($1.47, target $1.80) – the best is yet to be

Inspired by share price‐friendly actions in the last year, such as a dividend increase, a successful TDR listing, disposal of non‐core assets that were weighing down the balance sheet and the growing maturity of a new complementary business, Super has started to catch the eye of the market. As a result, valuations have crept up steadily from the lows of 2010.

However, we argue for more upside as the next two years’ valuations are still a long way off from the peak years of 2007‐08, especially now that the group has a dynamite new complementary business in ingredients and is beefing up its investor outreach to markets such as Taiwan where F&B sector valuations are richer.

In addition, Super’s shareholding structure is looking very interesting, as silent shareholder Yeo Hiap Seng (which owns 11.7%) is sitting on an attractive return of over 40% and its only representative has resigned from the board. Any increase in free float should lubricate the way for a further rerating.

Recent stories:

RH PETROGAS' chairman is 10th richest man in Malaysia, and a serial successful entrepreneur

GALLANT, CHINA FIBRETECH, SINO GRANDNESS: What analysts now say.....

CHINA ANIMAL HEALTHCARE down 5% on its dual-listing debut

Yuanta reiterates ‘Buy’ call on SUPER TDR with target price at NT$19.80

China Animal is prob the most disappointing stock -- it has big global institutional investors but the stock price cannot run. Worse, it has been drifting down.

c) Super looks fairly valued -- it hasnt corrected sharply but upside doesnt look great at all.

d) RH Petrogas -- who knows what this business really is? No news flow

a) RH Petrogas: 82 cents

b) Gallant Venture: 41 cents

c) China Animal: 27.5 cents

d) Super: $1.47

e) Boustead: $1.03

f) Starhill Reit: 62.5