Photo: Andrew Vanburen

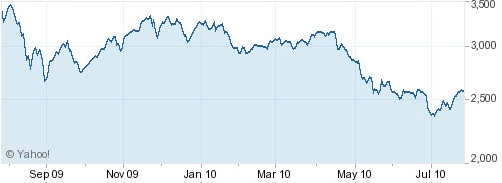

CHINESE SHARES are trading near three-month highs thanks in large part to standout performances by financials and property as well as pro-growth policy initiatives.

The benchmark Shanghai Composite rose again today, closing up 0.55% at 2,648.12, its highest level since early May.

While the bulls may soon be outlawed from running in parts of Spain, they are still very much making their presence felt in China’s capital markets.

Many investors may still be waiting on the sidelines for another big correction, but a leading authority on the Chinese stock market provides at least three in-depth reasons why these bystanders may be waiting for a long, long time.

Sentiment was buoyed even further this week after Tuesday’s vote of confidence in the economy by the People’s Bank of China.

The Central Bank said it was “cautiously optimistic” on the nation’s economic growth for the year, saying it thought the likelihood of a double dip slowdown was unlikely.

Lenders were in a celebratory mood today.

Notable gainers were recently listed Agricultural Bank of China, which added 2.2% to 2.8 yuan.

The other of the Big Four state-owned commercial banks were also up today with ICBC rising 1.9% to 4.4 yuan while Bank of China and China Construction Bank both rose by 1.4%, to 3.6 yuan and 4.98 yuan, respectively.

Meanwhile, China’s largest listed property developer China Vanke added 2.9% to 8.3 yuan while No.2 Poly Real Estate Group closed up 4.2% to just under 13 yuan.

A report in the official media that economic regulators would likely soon announce a stimulus plan for the cement industry sent Anhui Conch up the daily limit of 10% to finish at 19.6 yuan while domestic peer Tangshan Jidong Cement rose 4.6% to 18.4 yuan.

Party not over Yet

Guodu Securities said it saw at least three major drivers that would keep the bulls running in China’s capital markets, at least for the near term.

In a Chinese language piece in SinaFinance, the Beijing-based brokerage said that policy support, capital inflows and earnings expectations were all helping to bolster the "sustained bull run" argument.

"The 2,600-level is the new bull run foundation for the Shanghai Composite. At the same time, we are seeing more turnover and participation in the current market which is further evidence of a growing return of investor confidence,” Guodu said.

It said that undergirding this confidence is a noticeable relaxation on macroeconomic controls from Beijing of late and more effective capital reform measures taking hold, all of which help keep investors from cashing in short-term gains, convincing them to hold positions with more confidence.

"In this environment, we see the recent rally possibly going on for quite some time,” it added.

It said that macroeconomic controls by the government -- and then recent 're-relaxation' of these same measures -- has boosted sentiment across the board and removed nearly all apprehensions of any additional credit tightening measures for the rest of the year.

"Fixed asset investment, industrial production and leading economic indicators have all evinced signs of acceptably moderate movement, and many economists are even predicting a slight downturn for the July Purchasing Manufacturers’ Index (PMI).”

The PMI, which is due out Sunday, is a critical barometer of manufacturing vitality in China.

While regional bourses very dependent on China’s demand for industrial raw materials (i.e. Australia and its massive iron ore and other mined exports) are dreading any decline in the PMI, a slightly lower number would almost certainly mean that China’s Central Bank would not be raising interest rates anytime soon – good news for A shares and property developers in particular.

However, a dip below the threshold of 50 would point to a Chinese economy in contraction, a scenario that neither Beijing and certainly Canberra would not wish to see.

To remedy the possibility that earlier slowdown measures may have gone a bit too far, Guodu Securities said Beijing has recently been loosening restrictions on new investment vehicles and toning down the rhetoric on the dangers of over-fast and speculation-based property growth.

"Therefore, we see the results in the renewed interest in developers and banks, and their recent valuation climbs serve as evidence of this,” it said.

Indeed, today’s biggest gainers were in the financial and property sectors.

"It is an open secret that the new taxes and restrictions on developers implemented earlier this year are basically being either unenforced or phased out, and recently stated rules banning the purchase of third homes are basically being ignored,” Guodu said.

"This hints at the likelihood that developers will not be targeted by economic regulators anytime again in the foreseeable future.”

This also meant that closely related industries such as steel, building materials and other cyclical shares would also benefit from operating under the government’s radar for now.

The growing confidence of individual investors is boosted by the seemingly longer positions being staked by institutional investors with their freed-up capital, both of which complement each other in a game of chicken, with neither side likely to blink for the time being thus helping sustain the bull run.

Finally, Guodu said that all indications were that the upcoming flurry of first half financial reports would likely, by and large, surprise on the upside, and this optimism was another factor keeping the bears at bay for now.

It said the best bets for now were new technology, especially new energy stocks, as well as consumption stocks.

Guodu was particularly bullish on pollution control equipment, smart grid technology, hybrid/electric vehicles, new materials, pharmaceuticals and travel stocks.

However, despite its optimistic near-term outlook, the brokerage cautioned that Sunday’s PMI release as well as July’s CPI figure would be critically important indicators informing macroeconomic action – or inaction – for the rest of the year, and investors ignore unforeseen movements in either indicator at their peril.

Read about China's 'Big Blue': LENOVO wants back into global top 3