GLORY MARK Hi-Tech (Holdings) Ltd (HK: 8159), a manufacturer of connectivity products mainly for computers and peripherals, is becoming the envy of its peers by successfully building up a very impressive list of global clients across a wide spectrum of industries.

Among them are Fujicon, Korean firms LG and Samsung as well as Lucent Technologies of the US.

Glory Mark’s CEO Mr. Wong Chun recently met with NextInsight, Aries Consulting and a group of Greater China fund managers to outline strategies for this year.

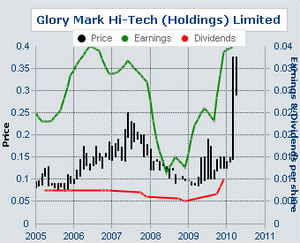

Mr. Wong Chun said the company was encouraged by a very solid first quarter.

Revenue in the January-March period rose to 94.5 mln hkd from 76.3 mln a year earlier.

This helped Glory Mark’s net profit in the first three months increase to 3.3 mln hkd from 2.6 mln, producing earnings per share of 0.97 hkd (up from 0.77 hkd in the first quarter of 2009).

Glory Mark, which products both on an OEM basis and under self-branded sales to retail distributors, operates several subsidiaries including Asia-Link Technology Ltd, Dongguan Glory Mark Electronic Co Ltd, Glory Mark Electronic Ltd, Glory Mark Development Ltd, Glory Mark International (Holdings) Ltd and Asia-Link (Fogang) Electronic Ltd.

The Hong Kong listed firm is deeply rooted in Greater China, with administrative and manufacturing facilities in Hong Kong, the PRC, Taiwan and Macau.

And a major reason for the company’s improved profitability in the most recent quarter was a steady climb up the quality chain, and the inherently higher premiums that OEM companies could charge clients when the manufacturing licenses, certifications and quality awards began piling up.

“Computer monitor cables represent our biggest revenue earner,” said Mr. Wong, referring to the connections between desktop computers and screens.

“People don’t realize how complex these connectors can be and the incredible amounts of data that are transferred. Therefore they are quite expensive and seldom interchangeable across brands and models.”

And this exclusivity and custom-like quality meant a lot of big contracts for Glory Mark, a leader in the connectivity arena.

“We are always working to focus more and more on the higher margin specialized products. We try to avoid accepting contracts for low-level mass production. Randomly purchased generic connectors only have a 25% chance of compatibility (data cable, monitor cable) so we get lots of different orders," he added.

Good Connections

Glory Mark has worked long and hard to build up a client base that reads like a Who’s Who in the world of IT and electronics.

Mr. Wong said that South Korean manufacturers Samsung and LG were two of its biggest clients, as well as Japan’s global connectivity giant Fujicon – its leading customer.

“We are the biggest cable connector suppliers for Samsung and LG. We have also been getting more and more orders from (US-based) Lucent Technologies, and have also been promoting medical technology connectivity products, which of course command some of the highest margins in the industry,” he said.

|

|||||||||||||||||

Glory Mark was by no means putting all its eggs in any single basket, because the company recognized that not only was the connectivity industry extremely diverse and multifaceted, but also rapidly changing along with technological progress and even consumer preferences.

“A lot of our Taiwan competitors are just focusing on two types of connectors and have huge production for these two product types. But we are far more diversified in our product line and have also been greatly developing our business by serving the connector and cable market demand from China’s fast-growing automotive market,” he said.

|

|||||||||||||

Not a bad decision, to be sure, as auto sales in the PRC overtook the US for the first time last year.

“We have been doing very well in LVD, VCD and HDML cable connectivity products, as a lot of these are not interchangeable. Many sockets and wires (adapters, cables, etc) are specific to a certain brand and therefore a company has to be very nimble and diverse to survive, let alone thrive, in this business.”

But he said that this did not mean Glory Mark blindly accepted every new order, but first conducted a quick and efficient feasibility study before signing on the dotted line.

“Before beginning a new product line, we do extensive research into potential profitability. Most people think data and monitor cables -- and power cords -- and their affiliated connection points are relatively simple, but they are in fact very complex, especially USB cables. They must meet each country’s requirements before getting approval.”

When asked if his business was threatened by the “wireless revolution,” he said that security and stability concerns would always provide a market opportunity for physical connectivity products like his.

“Our products ensure industry standard minimum data loss when sending a file from computer-to-computer, and there is no chance of hijacking data in a direct transfer. However, that is always a risk with wireless connectivity."

Glory Mark has four production facilities in mainland China: three in the southern Guangdong province city of Dongguang, and one in the north of the province.

See also: SIM TECH: Roaring ahead on 2H blitz