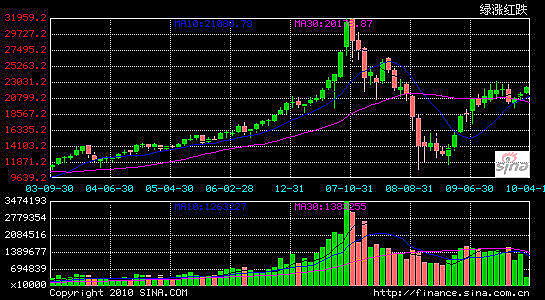

MARKET EXPERTS pooled by NextInsight are of a mixed view on where H-shares and A-shares are headed this week after the Shanghai Composite Index, the benchmark indicator for A-shares in China closed today down 0.51% at 3,129.26.

Property plays provided most of the downward pressure.

Meanwhile, Hong Kong’s benchmark Hang Seng finished down 0.3% at 22,138.17, after pulling back from a three-month closing high.

A Singapore-based analyst with Westcomb Financial believes concerns over an imminent one-off yuan appreciation are overblown, given Beijing’s penchant for surprising the pundits.

“The markets certainly welcome the consistent message given out by the authorities in China with regards to macroeconomic controls. There was some anticipation last weekend following secret visits by Tiny Tim (US Treasury Secretary Timothy Geithner) to Hong Kong and China, meeting with China’s Vice Premier Wang Qishan," said Mr. Kevin Lim, a Singapore-based equities analyst with Westcomb Financial.

“But knowing well how the Chinese authorities like to surprise the crowd, there would be no revaluation. Indeed, comments from Customs following the first trade deficit since 2004 further serve the idea that China will only revalue when the crowd least expects it (like in July 2005).”

He said he expects both the Hang Seng and the Shanghai Composite to see an uptrend this week.

“The markets, as usual, may be disappointed by the ‘No-Show’ on the exchange rate front, but it should remain very well supported. This week the markets should continue to ride on positive momentum.”

Major investment houses like Goldman, JP Morgan and Credit Suisse have issued tactical “Buy” calls on H-Shares for the second quarter of this year.

“Or they at least sounded out the relative attractiveness of H shares, as they, particularly the banks and property plays, have massively underperformed the other markets and are playing catch up. This should in turn benefit the Hang Seng Index, particularly the Hang Seng Enterprise Index,” Mr. Lim added.

The policy ‘vacuum’ as described by analysts (where the Chinese authorities are now waiting to see how the various tightening policies are playing out, as it requires a time lag for them to kick into gear) in the second quarter will continue to provide strong underpinnings, he said.

A margin trading pilot program was launched on March 27 in the PRC.

“The introduction of margin trading in Shanghai-listed A shares should have been well discounted, and the rumors of a possible introduction of a property tax should keep the markets edgy. But that should not dent too much of the optimism in H shares, as the other pivotal influence, the US markets, still seem to be enjoying a nice bull ride.”

However, he cautioned that investors in Hong Kong-listed and mainland-listed shares should keep an eye on US economic figures due out soon.

“Of course, momentum is again dependent on some key numbers this week. Look out for 1) weekly jobless claims 2) March retail sales numbers.”

Credit Red Light?

Another stock market expert was less sanguine on the market, given the possibility of rate action from the People’s Bank of China and the uncertainty about the currency exchange rate of the US dollar to the yuan, which is currently at 6.8 yuan to the dollar.

“I would say I am cautious about the stock market mainly because of the tightening of credit and the strength of the US dollar," Mr. Johnny Jia, investment manager with Shanghai-based CB International Invest Ltd, told NextInsight.

The current bull run in Chinese shares in both Hong Kong and in the A-share markets was overly reliant on overperformers and blue chips to carry the day.

"The market has been flying to quality these months while the second-line stock has been performing much weaker. That means the market is not confident enough as a whole for the entire market.”

Therefore, Mr. Jia said he was urging due caution for this trading week given both the macroeconomic policies on the table at home and the upcoming release of key performance figures from the US.

“Maybe there will be some more profit to be had, but I feel the risk is relatively high for me,” he said.

Related story: China Market Wrap: Earnings buoy H-shares, all eyes on exchange rate