CHINESE SHARES are likely to benefit from some buoyancy this week on strong earnings reports from ICBC (SHA: 601398; HK: 1398) and Bank of China (SHA: 601988; HK: 3988).

The lenders, two of China’s “Big Four” banks, benefited from expanded assets in 2009 and favorable policy moves.

PRC-based stock analyst Kate Zhang believes the strong showing from the financial sector last year will help drive up A-shares this holiday-shortened week.

Banking Boom

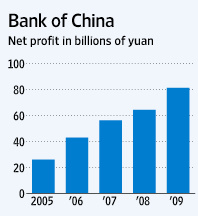

Bank of China, the country’s third largest lender, said its 2009 net profit rose 26% to 18.8 bln yuan on higher volume lending and diminished write-off expenses.

Source: BOC

The bank – the most heavily exposed in China to the US subprime meltdown – began to clean up its books in earnest last year, and reported that total impairment charges in 2009 fell to 16 bln yuan from 45 bln the year previous.

Meanwhile, China’s top lender ICBC enjoyed a 2009 net profit increase of 16% to 128.7 bln yuan on a lending spree.

“As Bank of China and ICBC, two of the three biggest Chinese banks, posted better-than-expected results for FY2009 last week, the clouds overwhelming this sector are clearing,” Ms. Zhang told NextInsight.

She said expanding assets and a partial retreat on stricter reserve requirements contributed significantly to the 2009 results.

“In particular, net interest margin (NIM) improved quite a bit in the fourth quarter which gives more confidence to investors. Tightening is expected to come later this year on rising inflation, which will help the big banks improve their NIMs even further.”

China’s CPI surprised on the upside in February, rising 2.7% year-on-year. This is much higher than the one-year term deposit rate of 2.25% offered by domestic banks which means savings account holders technically lost money over this period with the differential to inflation.

This has many analysts predicting that China will raise interest rates at least once, most likely beginning in the second quarter, to help offset fast money supply growth and curb inflation.

Beijing’s biggest worry is potential social instability emanating from economic uncertainty and the government puts a premium on keeping unrest at bay by providing the basics at affordable prices. Therefore, over-fast CPI growth is taken very seriously by economic regulators in China.

An interest rate hike or two will also lend support to the yuan’s valuation which will help ease China’s yawning trade gap with major global partners and lessen tensions.

This week is a shorter trading week in Hong Kong, with the markets closed from Friday, April 2 to Tuesday, April 6 for combined observances of Easter and Qing Ming. The Hong Kong bourse reopens on Wednesday, April 7.

The mainland stock market will take Monday, April 5 off in observance of Tomb Sweeping Day (Qing Ming).

Ms. Zhang said that this week, the last in the current quarter, will also bring in two new and very important financial products to the market.

“Investors, especially domestic investors, have a strong motive to lift the market for better settling performance. And margin trading will be launched on March 31 and index futures on April 16. I expect that A shares will be welcomed as the new thing to support blue-chips, although there are some limitations for majority investors,” she added.

However, Ms. Zhang said that investors should be wary of profit takers as the extended holiday draws near, especially in the Hong Kong bourse which will be off for a longer period.

“On the other hand, both the domestic (China) market and Hong Kong will take several days off due to the public holiday from the end of this week. I do expect some investors will take profits by covering their exposure and putting money into their pockets.”

Related story: CHINA MARKET WRAP: A-shares close up Friday on strong earnings