CIMB says ‘it’s a tech year’, highlights positive news from tech companies

Analyst: Jonathan Ng

• If you read this morning’s (Monday, July 19) “TODAY” news paper, you might have just rushed off to buy some tech stocks with the advantage of a weak market in line with the decline in the Dow last Friday.

• Tech sector remains attractive. “iPad and other gadgets are draining Asia of electronic components” screams the TODAY news article. “..strong demand exceeds our expectations….clients pushing us to increase supplies” says an anonymous Wintek official.

Source: CIMB report, July 19

• Profit guidance from SGX tech stocks, this time on the positive side. Juken Technology announced that it expects 1H10 revenue and profit before tax to exceed S$31m/3.3m versus S$18.6m/S$0.29m in 1H09.

• Rokko which is involved in semiconductor assembly and precision tooling used in the semicon industry announced that it expects to post profit before tax of S$3.0m to S$3.5m for 1H10 compared to a loss of S$1.2m in 1H09. 1H10 sales are expected to hit more than S$20m, versus S$5.6m in 1H09. Interestingly, Rokko also plans to recommend an interim dividend.

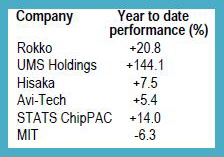

• Another tech company that is likely to propose an interim dividend and report better profits than last year first half is MIT. This stock has been a laggard amongst its brethrens in the semiconductor industry. With improving corporate news flow, we believe the stock will play catch up in the second half. For short term players, technical resistance is seen at 17 cts.

NRA Capital initiates coverage of Fuxing China with ‘strong buy’

Analyst: Jacky Lee

Initiate coverage with Strong Buy recommendation. We view Fuxing China Group (Fuxing) to be attractive given it is currently trading below net cash per share of S$0.16, compared to its peers with an average 11x forecast PER and 1.7x PBR.

We peg Fuxing’s fair value at 11x FY11 PER,the higher range of its 3-year rolling forward price or S$0.28, and this translates into 1x PBR. Our 40% dividend payout ratio projection also implies an attractive yield of 6-9% for year 2010 to 2012

.

Second largest zipper manufacturer in China. Fuxing is a manufacturer of zipper sliders and zipper chains in the PRC. Its products are sold mainly to local manufacturers of apparel and footwear products, camping equipment, bags, upholstery furnishings as well as other zipper manufacturers that further process or assemble its zipper products in order to customise these to their customers’ needs.

Emphasis on quality and R&D. Fuxing’s R&D facility was certified as a Fujian Provincial Level Enterprise Technology Center in Dec -06. The group owns 18 design patents, 2 utility patents, 1 invention patent and recently received approval for its application of the Super Durable Zipper patent. In Oct-09, the group was awarded the “New and High Technology Enterprise” by Fujian Provincial Government, which qualifies the group for preferential corporate tax rate of 15% for 3 years (down from 25% currently).

Global growth forecast of 10%. According to Global Industry Analysts, Inc, world zipper market to reach US$7.7bn by 2015 and believe Asia is also the faster growing region in the global zipper market. In China, the zipper industry has grown an average rate of 20% annually for nearly a decade. Despite the tough times in the past two years, recent figures from the China General Administration of Customs, up to May, showed exports of textiles and apparel rose by 19.3% yoy. We expect demand for zippers toa ccelerate after the global financial crisis.

Zipper industry is a highly-fragmented market, there are 2,000 zipper manufacturers in China. Despite the barriers to entry being low, we believe it would be relatively difficult to scale up to a certain level of product technology. Today, the world’s largest zipper manufacturer, YKK Zipper, has a more than 70% share of the high-end zipper market.