Excerpts from latest analyst reports…

Excerpts from latest analyst reports…

OCBC IR says Valuetronics is ‘set to produce yet another strong set of results’

Analyst: Kevin Tan

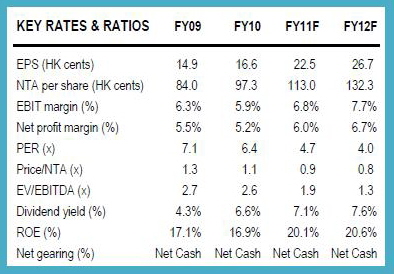

Strong momentum in market dynamics. We believe Valuetronics Holdings (VHL) is set to produce yet another strong set of results for its 1QFY11, after exceeding our expectations in its fiscal 4Q. Industrial production in China has continued to be strong and steady in May, with the manufacture of communication equipment, computers and other electronic equipment registering growth of 17.8% YoY, according to the National Bureau of Statistics of China.

Overseas shipments for the month also grew by 48.5% YoY notwithstanding the European sovereign debt crisis and surpassed market's call for a 30-33% growth. We expect this strong momentum in market dynamics to drive VHL's turnover in 1QFY11, with a potential to yield a second straight quarter of sequential growth.

Positive outlook from customer and market watcher. We also note that its largest customer, Philips Electronics, estimated to contribute ~47% to its FY10 sales), had provided a more upbeat outlook during its 1Q10 results amid higher-than-expected sales growth in all its core business segments.

Source: OCBC Investment Research, June 25

Source: OCBC Investment Research, June 25

Particularly, the group guided that it expects to sell a significant number of LED lighting installations in 2010 and step up its marketing investments in its consumer lifestyle segment. This may potentially boost VHL's performance in the upcoming quarters.

As recently projected by research firm Research and Markets, the global consumer electronics industry is likely to grow at a CAGR of ~5% during 2010-13. As such, we are sanguine on its business prospects on a longer term as well.

China's move for RMB revaluation may raise opex. On concerns that the recent salary hike at Foxconn International may put pressure among other EMS/ODM companies and trigger a wave of wage adjustments in their China facilities, we also learnt from management that there is no negative impact from the incident as its factory average wage is already above the minimum wage requirement, having gone through the wage adjustment exercise in 2008.

Nevertheless, with China's recent move to allow for limited revaluation of RMB (possibly strengthening of the currency), this would come in line with management's guidance and our expectation for higher operating costs in the coming quarters.

Kim Eng Securities reiterates buy call on Otto Marine with target price of $0.58.

Analyst: Eric Ong

Otto Marine's yard in Batam. NextInight file photo

Otto Marine's yard in Batam. NextInight file photoWhat’s New

Otto Marine said that its wholly‐owned subsidiary, Surf Subsea Pte Ltd, will be taking a 19.2% stake in the US‐based joint‐venture company, SURF Subsea Inc. The latter was founded by Mr Wade Abadie, who has more than 20 years of experience in offshore service companies. The JV recently procured a 292‐ft Class 2 DP MSV at a “distressed” price of US$55m.

Our View

The US‐flagged vessel, named DMT Emerald, will enable Otto to gain a foothold in the North American market. It is equipped with ROV capability that will allow Otto to expand into other subsea and offshore construction works. In our view, this would create more growth opportunities for its new Geophysical segment.

Separately, Otto has entered into a 20‐year time charter with SURF for the exclusive use of the vessel and provided a shareholder loan of US$24m, as well as corporate guarantee, to finance the procurement of the vessel. The loan will be charged at an interest rate of 4.0% pa with a five‐year maturity period. There is no material impact on our FY10‐12 EPS forecasts as we await more details from management.

Action & Recommendation

Despite market concern over potential vessel cancellation (after Mosvold terminated its first shipbuilding contract in May), we reckon that Otto’s integrated business model can provide alternative options such as redeploying the vessel for the group’s chartering business. To replenish its orderbook, management is actively targeting higher‐spec newbuild contracts worth US$100‐200m. Reiterate BUY with target price of $0.58.