Analysts: Yew Kiang Wong & Dhruv Vohra

The S-Reits have outperformed the market YTD and still offers higher yield than the market and telco sector. We continue to favour fundamentals in the industrial and retail space and we screen the S-Reits for earnings defensiveness and financial flexibility via 12 metrics which supports our positive outlook on the industrial and retail Reits.

Valuations are attractive in view of a stronger sector balance sheet and lower risk of further recapitalizations. We like AREIT, MLT, Cambridge Reit and CMT.

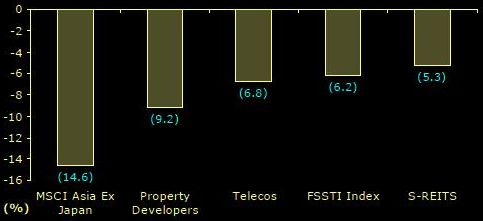

S-Reit yield versus other sectors. Source: CLSA Singapore

S-Reit has been more resilient than most would expect

� Recent market correction has seen the S-Reit sector outperforming the broade rmarket including the widely perceived defensive telecommunications sector.

� Yet, S-Reit still offers a yield of 7.1% versus market of 3.0% and the telecommunications sector of 5.3% yield

� Post the deleveraging cycle, the S-Reit sector average gearing of 32% is in line with historical average of 30%.

Fundamentals for industrial and retail more promising

� In the S-Reit universe, we like the industrial Reits for their earnings resilience and the retail sector for its proxy to higher tourist arrivals and retail sales.

� Meanwhile, the office sector is likely to evolve into a two tiered market with rentals holding up better for new office buildings versus the older CBD buildings.

S-Reits' resilient performance year to date. Source: CLSA Singapore

Cherry picking

� We screen earnings defensiveness and financial flexibility using 12 metrics.

� Under earnings resilience, industrial Reits is most favoured for its highest weighted average lease expiry, a high occupancy rate and wide tenant base

� Retail Reits are also better placed compared to peers in terms of financial flexibility with lower gearing and the highest level of interest coverage over other sectors.

� Office and mixed commercial Reits have marginally higher gearing and weaker debt profile.

Cambridge REIT (48 c) has a yield of 11% for the current year and 10.5% next year. Its gearing is on the high side, though, at 43%.

Defensive yields with attractive valuations

� With lower sector gearing and stable physical asset yields, most Reits would not need to recapitalize further in our view.

� Sector valuations are attractive in our view with the removal of such potential dilution coupled with the sector’s earnings resilience

� S-Reits now trade at 0.8x P/NAV or 20% discount to historical average of 1.0xP/NAV. Sector offers 7.1% yield or 459bps above Singapore ten year bonds.

� We like AREIT, MLT, Cambridge Reit and CMT, and we upgrade MLT to BUY from O-PF as our target price now offers more upside.