FOLLOWING THE Monetary Authority of Singapore (MAS) announcement on Wed to allow a modest appreciation in the SGD, Credit Suisse, Deutsche Bank and UBS are forecasting a strong stock market by end 2010.

Credit Suisse: “Strong 1Q real GDP growth, tighter monetary policy”

To Credit Suisse analyst Wu Kun Lung, the MAS move reflects a combination of factors:

1) a better global growth outlook,

2) a stronger-than-expected real GDP growth, and

3) inflationary pressures from the supply side (i.e., higher commodity and car prices) and a tightening labor market

His 2010 forecast for Singapore’s real GDP growth has been revised to 9.2% (up from 6.2%).

The reason cited: global recovery sequentially, and Singapore, being the most open economy in the region, stands to benefit from the rebound in global trade.

Credit Suisse expects a 3% to 4% appreciation of the Sing dollar over one year.

UBS: “Buying opportunity in mid-term STI weakness”

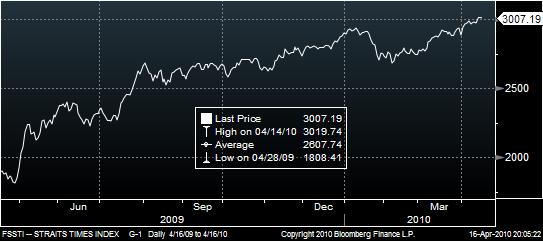

UBS analyst Tan Min Lan expects the Straits Times Index (STI), now at 3,007, to be weak bewteen Apr and Jul.

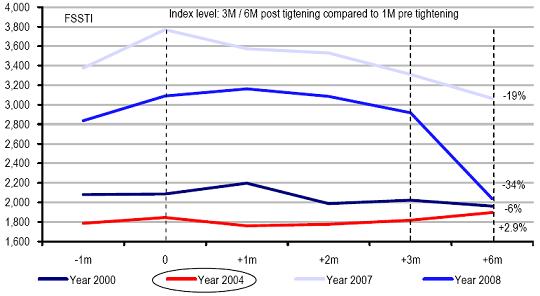

Based on UBS research, the index had historically risen up to 10% in the month immediately following an exchange rate tightening policy, but fallen by up to 12% in the subsequent one to 3 months.

However, policy tightening does not always signal the end of rising markets if growth holds up and inflation is kept in check.

UBS is forecasting that the Singapore market will be stronger by end-2010, and expects an uptrend in the second half of 2010.

Short-term (1 quarter) weakness and UBS’ projection of exceptional growth in the mid term (1 year) presents opportunities for stock accumulation.

The analyst cited the following “cash generative” stocks as being likely to outperform in the next 3 months: SMRT, SPH, SATS, Parkway, M1, SPOST and S REITs.

This is because the prospect of currency appreciation should raise the attractiveness of Singapore assets - bonds, properties and cash-generative stocks (especially those with large S$ revenue and some foreign currency denominated costs).

However, tech stocks and stocks with significant foreign currency denominated revenue will be most hurt by the stronger S$.

Deutsche Bank: “Shifting focus as rebound peaks”

Deutsche Bank is overweight on Singapore banks, property, aviation, conglomerates, offshore & marine and commodities, and neutral on REITs, container shipping, land transport, healthcare and telecommunications.

Banks

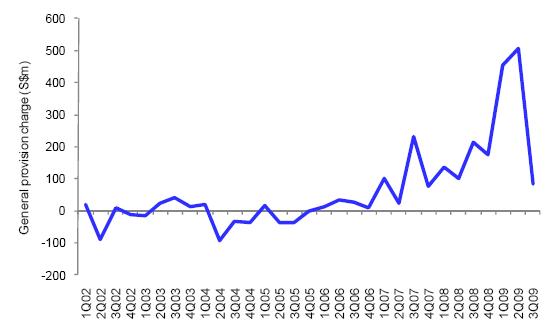

Analyst Andrew Hill expects the improving economic outlook should benefit Singapore banks in three key ways:

1) loan growth recovery in 2010,

2) falling loan losses and

3) reduced capital requirements on banks

DBS is Deutsche Bank’s top stock pick for the banking sector, because of its attractive relative valuation, potential benefits from loan-loss normalization and additional upside to net interest margins as interest rates normalize in the medium term.

The analyst expects a decline in loan losses in 2010 to be a key driver of sector-leading EPS growth of 25% for DBS.

Property

For the residential market, analysts Gregory Lui and Elaine Khoo see news flow and activity this year dominated by the high-end segment.

Unlike the mass- to mid-segments, where prices have rebounded to peak levels, high-end prices are still around 5-150% below peak and demand should be supported by the improving economic outlook, low interest rates and rising foreigner participation.

The analysts expect modest growth for the low-end segment (+3%), with government policy more restrictive and pent-up demand largely consumed, and a larger 6-12% upside for high-end prices.

Also, office rental declines have eased after falling almost 60% from the peak, restoring Singapore’s competitiveness vis-à-vis Hong Kong.

Leasing activity and pre-commitments have also picked up strongly, with MNCs and financial institutions expanding again.

Its top stock picks in property are Capitaland, Keppel Land, and Allgreen.

It likes Capitaland for its capital recycling model, Keppel Land for its leverage on the office sector and Allgreen for its exposure to the upper- and mid-residential segment.

Commodities

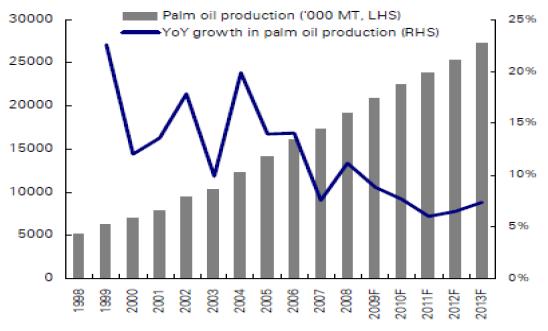

Analyst Teoh Su-yin is bullish on crude palm oil (CPO) and expects overall edible-oil supply to surprise the market on the downside, and demand to remain robust, helping to push down stock/usage ratios of all edible oils and squeezing prices upwards well into 2011.Another catalyst is a resumption of weakness in the US dollar.

Deutsche Bank has increased its average CPO price assumptions by 10% in 2010E to RM2,750 per metric ton and 17% in 2011E to RM3,150.