ONE OF THE richest men in Singapore has now become a major shareholder of Teckwah Industrial.

Ho Bee Investment CEO Chua Thian Poh has raised his interest in Teckwah through a vehicle that has just become a substantial shareholder of Teckwah.

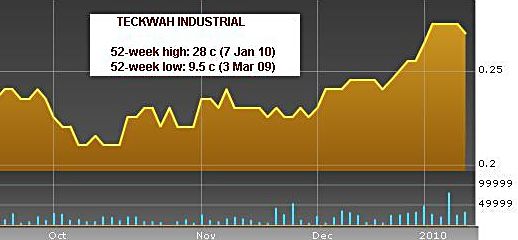

It was announced last night that on Jan 7, Airjet Auto-Care bought 586,000 shares of Teckwah at S$0.2758 apiece.

That brought its total holding of Teckwah (www.teckwah.com.sg) to 12.11 million shares, or 5.19%.

Airjet Auto-Care is a wholly-owned subsidiary of Ho Bee Holdings, which in turn is 69% owned by Mr Chua and 17.5% by his wife, Madam Ng Noi Hinoy.

With a net worth estimated at US$450 million, Mr Chua was ranked the 16th richest man in Singapore by Forbes.com last year.

Mr Chua is not unfamiliar with the senior management of Teckwah, a relatively low-profile company which reported a $5.1 m net profit in the first half of this year, or 2.2 cents a share.

(More interestingly, it had $40 million of cash on hand as of June 30, which is massive amount to its current market capitalisation of $63 million.)

In the Singapore Chinese Chamber of Commerce & Industry (SCCCI), Mr Chua was the immediate past President, while Teckwah chairman and MD Thomas Chua was chairman of the General Affairs Committee of the SCCCI.

There are several other organizations where they work together, including the Singapore Hokkien Huay Kuan where Mr Chua Thian Poh is vice-president and Mr Thomas Chua, the chairman of its education committee.

Oh, by the way, the two Chuas are not related.

Teckwah shares closed at 27 cents yesterday (Jan 11).

* NextInsight had an article in November TECKWAH: A deep-value stock?