KARRIE INTERNATIONAL Holdings Ltd (HK: 1050) takes a page from its product line in its unending quest to maximize returns, enhance value for shareholders and stay ahead of the competition in the hypercompetitive moulds and casings sector.

The Hong Kong-listed firm continually moulds its products – and remoulds its strategy – to fit on-the-ground market conditions and meet the sometimes fickle and always exacting demands of major clients around the world.

In a recent interview with NextInsight and Aries Consulting, Karrie’s Executive Director Mr. S.K. Lee said the company, which has been listed in Hong Kong for 13 years, is always keeping its ear to the ground and fine-tuning its tooling regime to anticipate changes in the market before the competition catches on.

“In the 1970s we started with toys, then moved to moulds and audio cassette tapes. Then came VCR tapes in the 1980s because they were very profitable at the time. Then, in the late 1990s, we bought a small metals firm which allowed us to expand to metals, plastics and mould making capability. So now we can make many products and can work with big computer companies like HP and IBM,” said Mr. Lee.

What doesn’t kill you…

To be involved in such a competitive industry from such an early stage in Hong Kong’s -- and Greater China’s – development has afforded Karrie International a kaleidoscopic view of the twists and turns the sector has endured over the decades.

And as the survivalist battle cry goes: what doesn’t kill you makes you stronger.

Judging by Karrie’s timely transformations and market-led adjustments, the company is more than a survivor, but also a hard core, savvy competitor.

“The past decade or so has been somewhat tumultuous for us, and the industry as a whole. After listing in Hong Kong in 1996 we then faced some provisions write-offs in 1998 due to the Asian Financial Crisis. Then we began focusing on our core OEM business,” Mr. Lee said.

He added that the renewed emphasis on its core strength – OEM manufacturing – was a sage choice as major global name-brand clients not only lined up but continued to sign checks even until today and solidify revenue streams.

However, the company benefited from anxiety in the market as the turn in the millennium approached as fears of a global IT meltdown loomed due to concerns that computers and networks programmed to recognize two-digit years suddenly had to go from “99” to knowing what to make of “00.”

“In 1999 a lot of people were worried about the Y2K phenomenon and bought new computers or upgraded systems. This provided a big boost to our order book.

“However, when this sales flurry petered out and worries over Y2K collapses proved exaggerated, sales quickly came down from the peak so we needed a new business focus. That is when we decided to diversify into ink jet printers, then progressed to color and then laser printers,” he said.

Japanese printer maker Mita was one of Karrie’s earliest customers in the sector before the brand was soon bought out by Kyocera, another peer manufacturer from Japan.

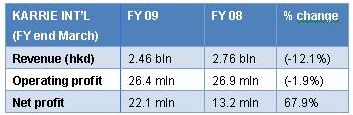

“In 2005 we had around 180 mln hkd in net profit, but last year it was 20 mln hkd. This was due to turnover declines, cost increases, a higher yuan, oil prices and higher material costs. These past few years, our performance has not been too good as we’ve been sandwiched by higher costs and falling revenue,” Mr. Lee said.

He said that as a maker of contracted products for namebrand global manufacturers it was therefore a client-driven rather than a consumer-driven firm, and the company had a reliable group of stable, steady financially-sound clients.

In fact, its top five customers currently account for around three-fourths of total turnover.

This did not mean that consumer sentiment did not affect its bottom line, but it did enjoy a lagtime of sorts as slower foot traffic at electronics stores and office supply outlets took time to trickly up to OEM firms like Karrie.

“We make corporate products, not consumer products. So we are anticipating a sales rebound somewhat in synch with consumer sentiment. However, there is a lag for us.

“We are OEM-based so we are led by our client orders, not direct consumer demand. But we are looking to move to ODM for printers and PC casings,” he said.

Making the case for a quick turnaround

The executive director of the manufacturing enterprise was upbeat on prospects over the short term.

He said that the company’s main upstream material expenses were originally plastics, but since the takeover of the metals firm and the refocus on computer casings, galvanized steel prices now were the biggest concern of the firm’s purchasing department.

“Our main cost is now steel, with plastic to a lesser extent. Thanks to our heavy reliance on Japanese orders and their relationships with major Japanese steelmakers, we do enjoy some cost-side benefits when buying steel from Japan,” he said.

Karrie International bought the vast bulk of its high-quality galvanized steel sheet from Japan, despite its higher cost relative to regional steelmaking rival nations China and South Korea.

“We mainly buy steel from Japan because the quality is much better than in China, especially considering our focus on OEM manufacturing is for external appearance parts and pieces which greet the end-consumers’ eyes.

“Our customers still insist on high quality steel so we are reliant on Japanese steel. We use cheaper Chinese and sometimes Korean steel for some internal steel applications,” Mr. Lee said.

But better negotiating power due to the cozy relationships that many Japanese blue-chips enjoy under the enigmatic keiretsu relationships.

Yes, labor costs are higher as China’s living standards rise and put commensurate pressure on worker salaries in Karrie’s production base – Guangdong province.

“Changes in labor rules in China and increased wages have resulted in increased costs for us.”

Karrie’s solution was to not only automate, but cut its payroll to protect margins.

“Increased labor costs led us to use more robot hands now. Also, we cut our PRC-based workers to 6,000 now from 7,000 last year,” he said.

Meanwhile, Hong Kong staff currently number around 200, with 50 stationed in mainland China.

He also said there were other reasons to smile.

The current global downturn had hurt exports of its finished products, but orders were not affected once inked.

We had no real fallout from current financial crisis so far in terms of deferred or defaulted payments yet. But admittedly, we have had to sometimes push them.

And the company was keen on keeping down costs to pad margins.

“The minimum wage is more or less frozen in China amid the slowdown and yuan appreciation has stabilized,” he said, referring to a major worry factor for export-oriented firms.

He also had faith that oil and steel prices would be relatively cheaper than last year going forward.

“This will lower our overall costs.”

Mr. Lee remained very sanguine on Karrie’s fortunes next year and beyond due to a steady and solvent group of loyal Japanese clients, an integrated production system that allowed savings on inventory costs due to just-in-time manufacturing capability, and what he proudly called “excellent corporate governance.”

“Next year we expect a recovery for us. We have been working hard on many projects with customers and should be refitting and retooling-ready by next year. Of course it all depends on the macroeconomic situation but we expect next year to be better than this year.

“We believe that with more projects than last year the quantity and quality of projects will increase. We hope that due to our ongoing investments in hardware and equipment we will be in a strong position to rebound when the economy rebounds.”

Concerning Karrie

Karrie is principally engaged in metal and plastic making and Electronic Manufacturing Services business (EMS Business).

For metal and plastic business, products include computer casings, office automation products, moulds, plastics and metal parts.

For EMS business, products including laser printers, magnetic tape drives, digital photo printers, multi-functional fax machines and other computer peripheral products.

It also benefitted from a strong presence making kiosks for use at the Hong Kong Jockey Club.

The majority of products are produced on an OEM basis for some of the biggest names in the computer and office automation industries.

Recent story: KARRIE INTERNATIONAL: A HK company that has tea with investors