THE SETTING MAY have been old school – the classical retro interior room at the highly exclusive members-only China Club – perched on the penthouse floor of the Old Bank of China Building in Central, Hong Kong.

But there was nothing “old” about what the CEOs of France’s Partenaires-Livres (Book Partners) and China Print Power Group Ltd (CPP) had to say to NextInsight in an exclusive interview in Hong Kong last week.

Singapore-listed CPP is a leading books & specialised products printing group serving the international market. Clients include major international publishers and retail stores across Europe, North America and Asia, such as Barnes & Noble.

A quick read of Book Partners’ homepage on the Web reveals the importance it and its 50%-held Hong Kong-registered subsidiary -- Book Partners China Ltd – place on growth prospects in Asia, and especially China.

“If there is one field in which the Chinese have outdistanced Europe, it has to be in the production of books. In effect the Chinese were the first to master the manufacture of paper for printing and reproduction and today dominate Europe in this domain. For this reason Partenaires Group is presently investing in China with the aim to purchase a factory to produce initial printings for our European clients,” Book Partners writes on its official website.

Nearly two years ago, Book Partners bought eight mln shares, or around a 7% equity stake, in CPP, but not after shopping around Greater China to look for just the right partner.

“In 2007, first half, we visited many printings plants. We didn’t find what we were looking for until we met China Print Power.

“CPP could provide a good service, and good quality. The management team is young, aggressive, active and efficient in practice. And they are experienced, so they know the business very very well,” said Mr. Pascal Pluchard, CEO of Partenaires-Livres.

He added that Book Partners began placing its initial printing orders with CPP last year, and hasn’t looked back since.

“We decided that CPP was capable of offering very good quality goods and services, and good management. I can say their management is outstanding, so we decided to invest in CPP. We liked their young staff, management, capable, experience. When you are young, you are more aggressive.”

Mr. Pluchard said that while his company is based in France, and has “a lot of business” all over Europe, Book Partners took the plunge in Asia with the equity purchase in CPP in August of 2007.

| China Print Power (HK$’000) | 2005 | 2006 | 2007 | 2008 |

| Revenue | 157,948 | 164,512 | 210,894 | 264,205 |

| Net profit | 20,661 | 24,651 | 26,626 | 17,659 |

He said that although Book Partners is European, “we have look at the global market, so we need to also invest in Asia.”

Mr. Pluchard said the goal in Asia was to meet the needs of the mass market, one of the French firm’s two client categories.

“We have two global markets: the proximity market and the mass market.”

He explained that the first focused on clients with custom-tailored, high-end orders who required delivery under a tight time frame, but with much better per-unit margins.

“In the proximity market you have to deliver quickly, you sell a service and you sell at very good quality. This is versus the mass market, where you have lower prices. We cannot really produce at a better price in Europe, so in Europe it seems we only have the proximity market.”

He said that for mass market orders, Book Partners might have one or two months to get orders into clients’ hands.

“We mainly serve the proximity market in Europe and the mass market in Asia. The US has both. We see lots of opportunities in China. We try to stay in our core business of course, but if there is a new opportunity, why not?”

He explained that in the global printing industry, the book market represented around 5%, with magazines taking up the bulk. In China the number was as high as 10% given the growing popularity of educational and technical publications, which further demonstrated the tremendous market potential here.

And that is where its tieup with CPP comes in.

“As long as CPP can maintain consistency and production capacity, we will be willing and happy to transfer more print jobs to them. And as long as CPP can maintain their consistency, good service and good quality, we will increase our turnover with them and increase transfer. It is a global strategy to transfer to Asia, and today we are some production to Asia,” he said.

No tome in sight to printing prospects

The age of the Internet may be here to stay, but rumors of the death of printing have been greatly exaggerated, said Mr. Pluchard.

“We are very optimistic about this industry. People need to read books, and they can’t change their reading habits overnight. We are confident in the book reading for at least the next 20 years or so. You can’t replace the book with a computer or other media, because books are a very good mode of communication.”

He said information broadcast via television and the radio comes, goes, and then disappears into the ether.

“But books are in print and always accessible at any time. For the next couple of decades we are sure that books will stay books. Too much is made about the demise of daily broadsheet newspapers and their correlation to books at the hands of computers. They are different. Although it is impossible that the market won’t change, but the global book market will more or less stay the same.”

He said Book Partner’s relationship with CPP is both a strategic investment and a long-term partnership.

“We have bought eight mln shares, and have an open order for one mln. We believe a good partnership should start not only with Thomas (Mr. Sze, CPP CEO), but with everyone at the plant. Secondly, it’s long term because it’s a strategic, long-term investment. We don’t buy shares to sell them, even if it reaches 50 sgd cents we won’t be sellers,” Mr. Pluchard said.

When asked to assess PCC’s current valuation in Singapore, he said he believed its share price was undervalued.

“We feel a reasonable share price should be around 30 sgd cents, largely based on shareholders’ lack of understanding of the company’s growth potential.”

He said that on the surface, CPP and Book Partners may look less like partners and more like competitors.

“We have a very good relationship. If there is any problem, for example on price competition, we will find a solution by two ways -- good communication, and good transparency. Through these, we won’t have too many overlapping operations, and we are actually more synergistic than competitors.”

View from Hong Kong: China Print Power

Mr. Thomas Sze, CEO of CPP, agreed with Mr. Pluchard that the printing industry is here to stay – at least for the next couple of decades.

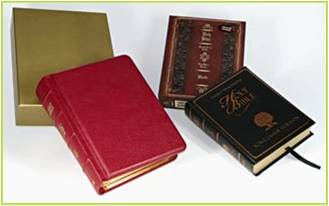

“It is hard to imagine people’s reading habits changing drastically in this time frame. This is especially true for some of the specialty products we print, such as art books, paper toys such as interactive board books, pop-up books, greeting cards, packaging and stationery. The items can hardly be replaced by online sources. We will try to follow this strategy and develop more business opportunities with these aforementioned customers to enhance our sales revenue,” he said in the interview.

On the business side, he was confident that Singapore-listed CPP’s recent earnings would improve, after the firm’s profit margins deteriorated last year.

In 2008, net profit was 17.7 mln hkd on revenue of 264.2 mln, compared with 26.6 mln/210.8 mln a year earlier.

“Quite a few factors contributed to our profit margin performance. The first is the currency appreciation of the yuan, so our overseas customers are less willing to buy the books. Also, the global economy has been deteriorating since the outbreak of the financial crisis in the fourth quarter, which puts a lot of pressure on us to offer more attractive pricing deals in order to outbid competitors.

“Also, there have been dramatic increases in material costs and we could not fully divert this inflation to customers. Labor costs have also been escalating significantly over the past year,” Mr. Sze said.

However, a variety of factors – including ongoing prestige buildup from its SGX mainboard listing in May of 2007 will help carry the day going forward.

“The listing obviously built up our distinctive company image as well as promoting our reputation against the competition. Customers feel very comfortable and confident to deal business to us, and we found it much easier to establish business relationships from new customers.”

He said that unlike many other SMEs operating in China, its cash flow remained robust.

“During the economic crisis, our banks did not cut any mortgage facilities from us so that we could maintain our healthy cash liquidity and financial stability in order to ride out the rocky time peacefully.”

He said Book Partners China (BPC) is a partner, and was not looking toward a takeover from the relationship.

“Although BPC is a printer as well, we have differentiated varieties of customers. BPC is likely to move many more European print jobs to China. As for a possible merger, I don’t think so. Perhaps instead they will invest more money, as they are devoted to the acquisition of more shares.”

Mr. Sze, CEO of the Hong Kong-based printer, said he shared Book Partners’ enthusiasm for the Chinese market.

“China will be more and more open to trade and investment. The government recently said it will open an ‘intellectual market’ in Shanghai, which is proof of growing openness. It is becoming a very open market. And although currently 100% of our revenue is from overseas orders, we will be looking to the PRC,” he said, referring to some of the still-existing restrictions Beijing puts on foreign publishers targeting the domestic market.

He said another issue dampening enthusiasm in China is the payment regime.

“Payment issues here are not fully mature. We can’t easily buy payment or credit insurance. Revenue is important, of course, but ‘no-pay’ scenarios are also important.”

Mr. Sze added that his company shared a common business philosophy with Paris-based Book Partners – profitability was paramount to production volume.

“How to realize and make more profits… that is our goal. While most manufacturers only are concerned with maximizing turnover, we are more concerned with profit margins. In the printing industry, a healthy profit margin should be 5-10%. Under that, there is little point.”

Post or read comments in our forum here.