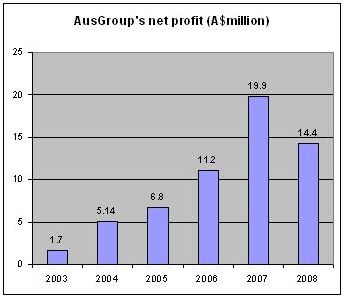

AUSGROUP yesterday (Aug 25) reported full-year results which its management conceded to be “disappointing” as net profit slumped 25% despite a 35% jump in revenue.

And the fourth quarter ended June 30 would have been a loss if not for a reversal of A$10.3 million for impairment to trade receivables.

All told, for its financial year 2008, AusGroup reported revenue of A$379 million and net profit of A$14.4 million.

At a briefing for over two dozen analysts and fund managers held at Suntec City yesterday evening, AusGroup MD John Sheridan, just about eight months now into his job, said earnings were impacted by:

* A legacy project from FY 2007 whose settlement for a variation in the contract was below forecast and hit this year’s financial statement;

* Conservative view on the outcome of a problematic project announced in Q3;

* Revenue growth that was below expectations from 100%-owned subsidiary Cactus. Going by geographic region, Australia’s revenue grew 41% while Asia (that is, Cactus) slipped 16%;

* Projection execution that was less than ideal for construction work AusGroup executed in some of its oil and gas projects.

The first two are one-off issues and action is being taken to improve operations, including the hiring of a general manager for the oil and gas business in April and targeting emerging market opportunities for Cactus.

It declared a final dividend, unchanged from the last financial year, of S$0.0061.

Strong outlook and order book

Analysts raised questions pertaining to commodity prices correcting recently. Are AusGroup’s clients hesitant about proceeding with some projects?

John replied: “Absolutely not. Particularly in Australia, a few of them are now talking to us about multiple-year deals to lock in our capacity for fabrication and construction. For players like us, the demand far outstrips the supply.”

Referring to some frequently asked questions, John said AusGroup has a natural hedge against forex risk as its contracts and expenses in Australia and Singapore are in local currency.

On whether the US subprime mortgage crisis and the resulting credit issues are impacting AusGroup, he said the group's business is growing organically and is being funded by its cashflow, so the impact is minimal.

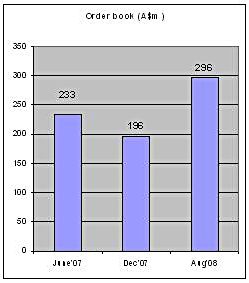

Reflecting the booming industries that AusGroup serves, the group’s order book now stands at A$296 million, a record.

AusGroup has current tenders for work amounting to A$395 million, whose results will be announced in the next couple of months. The bulk of its tenders are for oil and gas projects.

AusGroup expressed optimism of the strong demand for fabrication and construction services in the Western Australian natural resources sector – particularly the mining and oil and gas sectors.

Asked how likely clients might back out of contracts inked with AusGroup, John said: “When clients come to us, typically they have done all the engineering and procurement. They are well into the project. So for our business, it’s a very small risk of a client backing out.”

Given the strong pipeline of work that will buoy AusGroup, the group is taking measures to ensure that its bottomline better reflects the revenue increases that it is likely to achieve.

”The Group has a detailed strategy to address the challenges faced over the previous 12 months. The strategy implementation has commenced and will continue to be rolled out within the organization over the next 12 months.”

Recent story: AUSGROUP: Record half-time earnings of A$12.1 million