Markets look forward but people like to look backward.

LOTS OF gloomy forecasts on the stock market are out there, as we all know.

It’s so easy to just be part of the herd.

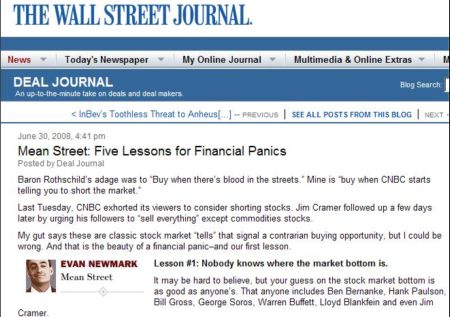

One article which stands out for its contrarian approach – and more than a dose of rationality – is Five Lessons for Financial Panics.

Before you do anything else, just read this excerpt by the writer Evan Newmark on Wall Street Journal:

”Anyone who sold their stocks on Black Monday, Oct. 19, 1987, came to almost immediately regret it.

I know I did. I was a junior banker in London and watched the meltdown on our lone department Quotron.

“My brain said, “Hang on, hang on.” My wallet said, “Run for your life.”

With one phone call, I sold every Fidelity stock fund I had and promptly lost a quarter of my net worth.

“The temptation to panic is primal. Be a man, not a monkey.”

Ok, here’s the link since we cannot reproduce the article in its entirety.

The article is followed by loads of comments from readers, such as the one below (just for some balance):

"Mr. Newmark does his readers a great disservice by telling them to hold their equities. This is what has been pasted into the public’s head by the media for decades now. If the media is so smart, why are they still working? There are times to sell and run, and this is one of them."

*****

Some news to cheer: An increasing number of SGX-listed companies and insiders are buying beaten down shares.

Here is a sample:

| Stock | Buyer | Price | Date | No. of shares bought |

| Beauty China | Absolute Partners Management | 30 June | 3,583,000 | |

| Fabchem China | Bao Hongwei (executive director) | 0.39 | 2 July | 370,000 |

| 0.375 | 30 June | 220,000 | ||

| Guangzhao Industrial Forest Biotechnology | Su Min (chairman) | 0.141 | 3 July | 106,000 |

| Song Xue Meng (CEO) | 0.15; | 25 June; | 25,000; | |

| 0.145 | 1 July | 29,000 | ||

| Ho Bee | Desmond Woon (executive director) | 0.782 | 3 July | 150,000 |

| Ho Bee Holdings | 0.7911 | 3 July | 130,000 | |

| Techcomp (Holdings) | Kabouter Management LLC | 30 June | 120,000 | |

| Sino-Environment | Share buy-back | 1.322 | 3 July | 1,050,000 |

Richard Lo, founder and CEO of Techcomp. Photo by Sim Kih.

Recent stories that mentioned Techcomp, Guangzhao IFB and Sino-Environment:

TECHCOMP: From HK$50K to S$70 million in 20 years

GUANGZHAO IFB: On the brink of a breakthrough

STOCK CHALLENGE: Pilot is flying high now