TPV sales in Q1 was US$2.38 billion, while net profit was US$45.4 million. Photo: annual report

TPV belongs to the earliest batch of stock that I bought when I began my investing journey.

Seven stocks were purchased at one go; since then, six have been sold. The last remaining stock is TPV Technology, which I bought more shares of in March 2007.

So what are the reasons for my inactiveness?

1) TPV never reached a price which I consider expensive. The decision to hold was relatively easy to make.

2) It is easy to hold on to a stock when the company keeps growing and producing good results. I extrapolated the past performance into the future. I did not notice that some part of the busines was deteriorating.

3) The stake is small. It is not worth the effort to trade frequently.

Inactiveness has yielded good results. The initial purchase price was S$0.42 and a recently traded price was S$0.88. There have been dividends over the years. Last year, TPV's dividends totalled 2.82 US cents a share, compared to 2.48 US cents in 2006.

So, sitting on my ass produced an annualised return of 14.11%, which is near to the 15% target I like to cross.

And this return did not happen because TPV share price merely became more expensive. In fact, the reverse is true as TPV is currently trading at a cheaper valuation compared to when I bought it initially. This also means the current return comes from an increase in earnings over the year.

The return will be higher if there is no dilution of shares through stock options and new shares issue.

Last year, TPV's earnings per share rose 15.4% to 9.21 US cents. That means the PE ratio was around 6.8 X based on a recent stock price of 88 cents.

| 2006 | 2007 | Q1 ‘08 | |

Sales US$ | 7.18 b | 8.46 b | 2.38 b (+27.2%) |

Net profit US$ | 151.8 m | 180.0 m | 45.4 m (+90.8%) |

Earnings per share | 7.98 US cts | 9.21 US cts | 2.31 US cts (+89.3%) |

TPV is seizing a bigger market share in the monitor business, faster than its competitors.

This is good news as the business of TPV is one of scale. But this growth rate is going to decline as the industry growth rate is slowing.

The market is consolidating into the hands of the top few players. In Q1, the top 3 players held 55.7% of the total supply, an increase of 3.2% from 4Q2007.

TPV alone took 2.7 percentage points of the increment while Samsung’s market share dropped 0.1% points and Innolux’s market share increased by 0.6% points.

I won’t be surprised if the top 5 or 6 players in this segment will gather bigger market shares going forward as the growth in LCD monitor slows to single digits.

I think TPV will be one of the winners or the biggest winner.

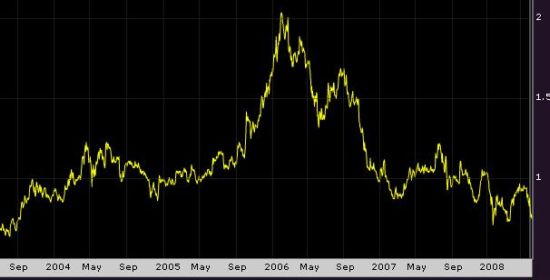

At the start of 2006, TPV traded above $2 a share.

Another helping hand for TPV is the market for LCD TVs. While this is a promising segment, independent contractors are not benefiting much as most LCDs are still being manufactured by the brands inhouse, which are mostly from Japan and South Korea.

TPV is losing market share to the brand names. This shows that unlike LCD monitors, it will be a hard and long road for independent manufacturers like TPV to gain a large market share in a short period.

While the LCD TV is going to be the future for TPV, the wave for LCD monitors is over and has been attacked by alternative products like notebooks which TPV do not manufacture.

While growth is going to be slower, capital expenditure will not increase much too. This paves the way for a stronger balance sheet by reducing debt and increasing dividend payments.

Despite huge capex requirements in the last few years, TPV has been unwilling to increase debt. In fact, it has actively reduced debt. But the unwelcome news is that TPV is diluting EPS by placing out big blocks of new shares to reduce its debt.

With a history of giving out a portion of it earnings in dividends, I am expecting TPV to do more of the same in future with increasing cash. While TPV is a well-run company, I don't expect to hold it for another 7 years. In fact I don’t think I will hold it for another few years.

I am holding on to it now because it is selling at a cheap valuation and it is illogical for me to sell it for another attractive company selling at a depressed price.

But in the next few months/years, I am hoping the market will provide opportunities for me to sell at a higher valuation or where I can make a meaningful swap.

This small investment in TPV has provided me a lot of lessons, which benefit me more than the monetary gains.

"Donmihaihai" is a 30-year-old retail investor. His previous article contribution was: CHINA STOCKS: Buying opportunities!