File photo showing Stuart Kenny briefing analysts during a visit to AusGroup's plant in Perth. Photo by Leong Chan Teik

But its share price ($1.18 close yesterday) has been knocked down some 40% along with the market which has been inundated with subprime-related news during the past three months.

“The changes that are coming about because of the US mortgage crisis – we don’t see them as having any material impact on us at all,” said AusGroup executive director Stuart Kenny at a briefing for analysts at Suntec City yesterday evening.

Giant iron ore mining company Rio Tinto is a client of AusGroup."The business areas we focus on are not exposed to changes in interest rates in the short term. The customers that we work for are blue chip and have financing in place.

Giant iron ore mining company Rio Tinto is a client of AusGroup."The business areas we focus on are not exposed to changes in interest rates in the short term. The customers that we work for are blue chip and have financing in place."Our company’s balance sheet is strong, our order book is strong, our future is strong. As for the funding arrangements we have with our bankers, we don’t see that’s going to change at all,”

said Stuart.

Subprime or no, AusGroup – which provides engineering solutions for the mining and oil and gas industries in Western Australia - has continued delivering record results. It “is on track for continued growth,” said Stuart.

Its revenue hit A$202 million for the half-year ended Dec 31 ’07, up by 60% year on year. Net profit rose 47% to A$12.1 million. “It’s clearly stellar growth,” said Stuart. Historically, ie for FY 06 and FY 07, the second-half accounted for 69% and 57% of AusGroup’s full-year results, respectively.

| Dec 31 ‘07 | June 30 ‘07 | Change | |

| Earnings per share | A$0.31 | A$0.21 | 48% |

| NTA per share | S$0.249 | S$0.219 | 14% |

| Return on equity (annualized) | 28.0% | 26.3% | 6% |

| Return on assets (annualized) | 15.0% | 15.0% | - |

| Net margin | 6.0% | 7.1% | -15% |

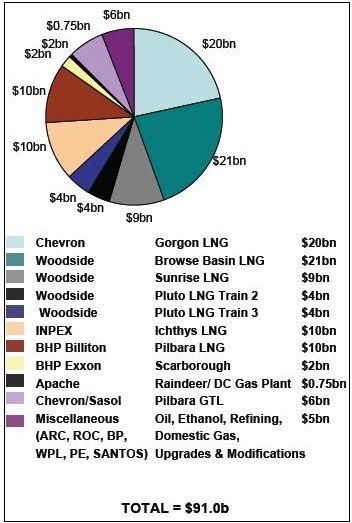

Future oil & gas investment in Western Australia. Source AusGroup.

Future oil & gas investment in Western Australia. Source AusGroup.Turning to some frequently asked questions that he has encountered, Stuart reiterated that:

* AusGroup is not exposed to forex risk, unlike some marine-related companies in Singapore that have taken a big hit.

AusGroup’s contracts in Australia are denominated in Aussie dollars while those in Singapore are in Singapore dollars.

“We don’t have forex risk in our day-to-day business.”

* Any fall in the price of oil is not expected to have a material impact on AusGroup.

The group’s Australian business, which accounts for most of its sales, is focused on the liquefied natural gas (LNG) market, which is driven by consumer demand for electricity in neighbouring countries and the US.

”We don’t see how a change of US$20 in the price of oil will make much difference,” said Stuart.

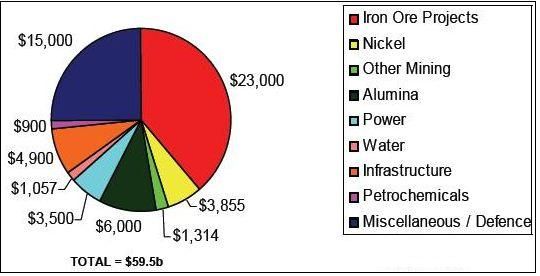

Mining & resources market size in Western Australia.

Mining & resources market size in Western Australia. Source: Department of Industry & Resources, WA.

What is making a difference to the future of AusGroup are the massive investments being made in Australia’s mining and oil & gas industries.

In the mining industry, about A$60 billion worth of projects are being developed.

In the oil & gas industry, A$91 billion of investments have been announced for the future. (see charts above)

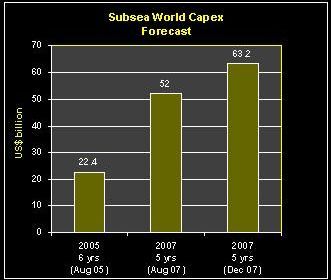

In Dec '07, the five-year capex forecast was raised to US$63.2 billion. Source: Quest Offshore Resources.Demand from China for iron ore for making steel, for example, is still strong, said Stuart.

In Dec '07, the five-year capex forecast was raised to US$63.2 billion. Source: Quest Offshore Resources.Demand from China for iron ore for making steel, for example, is still strong, said Stuart. "The Chinese have recently invested in Rio Tinto and are taking stakes in new mine developments in Western Australia.”

Virtually all of Australia’s iron ore is mined in Western Australia (around 98%). Australia produces around 17% of the world’s iron ore and is ranked third behind China (25%) and Brazil (20%).

There is also the booming global subsea oil & gas market that AusGroup’s Singapore subsidiary which was acquired last year, Cactus Engineering, is well-placed to tap. (see chart)

In the latest half-year results, no breakdown of the financial contributions was given for the Australian and Singapore operations.

Stock price is down about 40% from early Nov.Gross margins slipped from 17.1% to 15.7% because certain variation claims for work in Australia had not been finalised by the end of Dec '07, according to management.

Stock price is down about 40% from early Nov.Gross margins slipped from 17.1% to 15.7% because certain variation claims for work in Australia had not been finalised by the end of Dec '07, according to management.As at the end of Jan ’08, AusGroup has an outstanding order book of A$208 million, as compared to A$214 million in Jan ’07.

AusGroup currently has tendered for A$452 million worth of work, of which A$130 million is for oil & gas projects.

Aside from that, AusGroup is looking for opportunities for mergers and acquisitions in order to keep up its CAGR growth rate of 50% in revenue in the past five years.

”It’s pretty tough to continue growing at that rate organically," said Stuart. "I will identify and, where appropriate, we will seize opportunities to acquire further assets, so we can grow further in the future.”

*****

In a brief research note yesterday, UOB Kayhian analyst Mark Tan wrote: "We believe that the recent sell-down in AusGroup's shares is unjustified given both the strong industry and company fundamentals, and presents investors with an excellent entry point as AusGroup is currently trading at an undemanding 9.8x FY09 PE."

Mark's subsequent Feb 15 full report, where he kept his $2.20 target price, can be accessed by clicking here.