Hi-P is pumping capital expenditure into metal components manufacturing facilities to keep up with the trend shift in smartphone casings. Above at its results briefing, L-R: CFO Samuel Yuen, CEO Yao Hsiao Tung, COO Gary Ho. Photo by Allison Tan

Hi-P is pumping capital expenditure into metal components manufacturing facilities to keep up with the trend shift in smartphone casings. Above at its results briefing, L-R: CFO Samuel Yuen, CEO Yao Hsiao Tung, COO Gary Ho. Photo by Allison Tan At the reception after Hi-P's briefing, COO Gary Ho uses his Xiaomi smartphone to elaborate on its complicated machining process. Photo by Sim KihTOP SMARTPHONE vendors such as Samsung and Xiaomi are now using sleek metal frames to fight for market share.

At the reception after Hi-P's briefing, COO Gary Ho uses his Xiaomi smartphone to elaborate on its complicated machining process. Photo by Sim KihTOP SMARTPHONE vendors such as Samsung and Xiaomi are now using sleek metal frames to fight for market share.

To mitigate the lack of technology breakthrough, high-end smartphone players are betting on improvements in phone casing aesthetics to inspire consumers to upgrade their handsets, according to IT research firm Gartner.

This trend enabled Hi-P International to post a turnaround in its 3QFY2014 results after it became one of two suppliers for Xiaomi’s Mi 4 smartphone stainless steel frame.

The global integrated manufacturing service provider posted 3QFY2014 net profit of S$10.8 million after 3 consecutive quarters of losses.

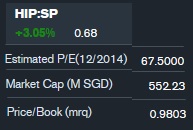

Bloomberg data

Bloomberg data

The following are highlights of its 3QFY2014 results.

>> Revenue decreased by 32.7% year-on-year to reach S$245.7 million due to decreased sales volumes by two key customers. This was offset by orders from existing and new customers.

>> Gross profit margin increased by 2.9 percentage points to 9.4% due to positive shift in product mix

>> Net cash surged from S$35.7 million as at 31 December 2013 to reach S$65.7 million as at 30 September 2014.

The smartphone outlook remains strong. More than 1.25 billion smartphones are expected to be shipped this year, up 23.8% year-on-year, according to research consultancy International Data Corporation.

The Group budgeted capital expenditure of S$115 million for FY2014, and will commence production at its new Nantong plant (phase 1A) at the end of this year.

Hi-P's results briefing was held at the Fullerton hotel on Tuesday.

Hi-P's results briefing was held at the Fullerton hotel on Tuesday.

Photo by Sim KihHi-P held a results briefing on Tuesday at The Fullerton hotel. Below is a summary of questions raised at the briefing and the replies provided by executive chairman Yao Hsiao Tung, CFO Samuel Yuen and COO Gary Ho.

Q: How are you financing your capital expenditure of S$115 million in FY2014?

We are budgeting about S$60 million of capex in Q4, mainly for the CNC manufacturing of metal components.

We currently have net cash of more than S$60 million.

The strong sales in Q4 will consume more working capital, which may lead to a net debt position at the end of December. We expect to move into a net cash position after that.

Q: How does your capacity increase with the additional facilities?

As at Q3, our capacity has more than doubled compared to the beginning of the year. We anticipate that our capacity will increase as demand increases.

Q: Do you have to take impairment charges for your plastic injection moulding facilities as you shift from manufacturing plastic components to metal? How does capacity utilization change for your plastic injection moulding facilities?

Sales for our plastic components will still grow. However, its revenue contribution will be proportionately less compared to metal components.

Recent story: HI-P INTERNATIONAL: UOB Kay Hian initiates coverage with 85-cent target price