Yongmao's tower cranes at its Macau Studio City project firmly installed in the ground. Company photo

Yongmao's tower cranes at its Macau Studio City project firmly installed in the ground. Company photo

THERE IS the overhead crane, the mobile crane and the tower crane -- each is designed to perform work specific to the industry where it is used.

These industries range from transportation (loading and unloading of freight) to construction (hoisting steel, concrete slabs and other building materials up skyscrapers).

Given the diverse industries, geographic reach and equipment types, the financial performance of one crane player may not always mirror the next.

This can be illustrated by considering three SGX-listed companies.

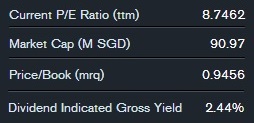

At 20.5 cents (Friday close price), Yongmao is trading at close to book value. Bloomberg dataSpecialist tower crane manufacturer Yongmao Holdings doubled its FY2014 net profit to Rmb 57.0 million (S$11.4 million, up 157.5% year-on-year).

At 20.5 cents (Friday close price), Yongmao is trading at close to book value. Bloomberg dataSpecialist tower crane manufacturer Yongmao Holdings doubled its FY2014 net profit to Rmb 57.0 million (S$11.4 million, up 157.5% year-on-year).

It is one of the world’s leading tower crane manufacturers.

Two thirds of its revenue comes from China, which is the world’s largest construction machinery market.

Its revenue from China grew 33.4% in FY2014.

It also has a strong presence in Singapore, commanding some 30% of the tower crane market here.

Yongmao’s earnings record has outperformed other heavy equipment players.

On the other hand, Sin Heng Heavy Machinery, a crane rental and trading company, posted 9MFY2014 net profit growth of 10.6% year-on-year to reach S$10.4 million.

Its rental fleet consists primarily of mobile cranes such as crawler cranes, all-terrain cranes, truck cranes and rough terrain cranes, as well as aerial lifts. It also has self-erecting (tower) cranes.

Tat Hong's crawler crane - mobile and capable of traveling. Company photo

Tat Hong's crawler crane - mobile and capable of traveling. Company photo

The company is well established in Singapore and has in recent years ventured into emerging Southeast Asian markets like Malaysia, Vietnam and Myanmar.

Tat Hong Holdings, Asia Pacific’s largest crane rental company, posted a sharp drop in FY2014 (March year-end) net profit - down 53% year-on-year at S$32.8 million.

About half of Tat Hong’s revenue comes from Australia.

The company was affected by a slowdown in Australia’s mining and LNG infrastructure activities, as well as weaker demand for specialized transportation services there.

A leading name in the rental of crawler (mobile) cranes, Tat Hong has a 23.95% stake in Yongmao.

Zoomlion Heavy Industry Science & Technology, one of the world’s largest crane manufacturers, likewise posted a sharp drop in 1QFY2014 net profit - down 33.1% year-on-year at Rmb 395.8 million (S$79.2 million).

Listed in Hong Kong and China, the company was plagued by forex losses when the RMB depreciated during 1Q2014, and faced difficulty in collecting its accounts receivables.

What are Yongmao’s competitive advantages? What advantage does the tower crane player have over those that deal in mobile cranes?

How many containers does it take to ship a crane? Who bears the freight? How do China cranes compare with those made in developed countries?

Next week, NextInsight will fly to its manufacturing base in Liaoning, China, to find out. The high tech facility is huge, sitting on 240,000 squares meters – equivalent to the area of 30 soccer fields.

Watch out for our story.

Recent story: YONGMAO: 9MFY14 Net Profit Up 143% On Record Sales